Key Takeaways

- Trading latency is the time delay between order initiation and execution.

- Low latency trading reduces slippage and boosts accuracy.

- Even milliseconds matter in high-frequency trading performance.

- Trading execution speed affects profitability and market timing.

- You can reduce trading latency with better internet, brokers, and hardware.

“What Is Low Latency? – Ultra-low …” from www.cisco.com and used with no modifications.

In the lightning-fast world of modern financial markets, speed is everything. QuantInsti, a leading algorithmic trading education platform, explains that even a one-millisecond advantage can translate to millions in annual profits for large trading operations. This critical time factor in trading is known as latency, and understanding it could be the difference between profit and loss in your trading career.

Latency affects every trader, from basement-dwelling day traders to billion-dollar hedge funds, though to dramatically different degrees. While institutional traders measure performance in microseconds (millionths of a second), retail traders typically work in the millisecond (thousandths of a second) range. But regardless of your trading level, unnecessary delays can erode your edge and diminish returns.

Milliseconds Matter: What Trading Latency Really Means

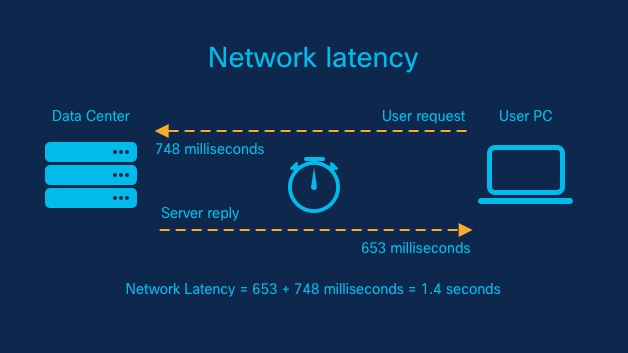

Trading latency is the total time delay between initiating a trade and its actual execution in the market. Think of it as the journey your order takes: from the moment you click “buy” or “sell,” through your device, across the internet, through your broker’s systems, to the exchange, and back again with confirmation. Each step in this process adds incremental delay that can impact your trading results.

In technical terms, latency encompasses the entire round-trip time for order processing. This includes the transmission of market data to your platform, your system’s processing time, order transmission to exchanges, and the return of execution confirmations. Modern markets operate at such speeds that these delays are measured in milliseconds (ms), microseconds (μs), or even nanoseconds (ns) for the most sophisticated trading operations.

The significance of latency varies dramatically based on your trading approach. For high-frequency trading (HFT) firms executing thousands of trades per second, a single-millisecond advantage can be worth $100 million annually, according to research from financial technology firm Tabb Group. For active day traders, latency differences of 100-500ms can mean getting filled at target prices versus missing opportunities entirely.

How Latency Impacts Your Trading Performance

Latency isn’t just a technical consideration—it directly impacts your bottom line. The most immediate effect appears in the form of price discrepancies between what you see on your screen and what you actually get when your order executes.

Price Slippage: The Hidden Cost of Slow Execution

Slippage occurs when there’s a difference between the expected price of a trade and the actual executed price. While market volatility naturally causes some slippage, excessive latency significantly worsens this issue. When your order arrives at the exchange milliseconds or seconds after you’ve initiated it, the market may have already moved beyond your intended price point.

This problem compounds during high-volatility periods when prices change rapidly. A trading system with 500ms of latency might seem responsive to human perception, but during that half-second, dozens of price changes could occur in fast-moving markets. The result? You consistently buy higher and sell lower than intended, creating a persistent drag on performance that compounds over thousands of trades. For those interested in exploring different trading strategies, consider checking out crypto arbitrage platforms as a potential option.

Missed Opportunities During Market Volatility

Beyond slippage, high latency can cause you to miss trading opportunities entirely. Market inefficiencies and price discrepancies often exist for only fractions of a second before being arbitraged away by faster market participants. If your system takes too long to receive market data or process orders, these fleeting opportunities will consistently disappear before you can act on them.

During breaking news events or economic announcements, markets can move dramatically in milliseconds. Traders with lower latency can enter positions at advantageous prices while higher-latency traders are literally left looking at stale prices that no longer exist. By the time high-latency systems reflect current market conditions, the profit opportunity has often vanished. To stay ahead, traders are increasingly leveraging AI to trade stocks efficiently and effectively.

Real-World Latency Example: During the 2010 Flash Crash, when the Dow Jones Industrial Average plunged about 9% in minutes before recovering, trading systems with lower latency allowed some firms to navigate the volatility profitably. Meanwhile, retail traders with high-latency connections received quotes that were seconds old—effectively trading blind during the market’s most dramatic movements in years.

How Much Latency Actually Costs Traders (In Real Money)

The financial impact of latency is measurable and significant. Studies from financial technology provider Pragma Securities found that for every millisecond of reduced latency, trading firms saw execution quality improvements worth approximately 10 basis points (0.1%) on their trades. For a fund trading $100 million daily, that translates to $100,000 in daily savings—or over $25 million annually.

The Main Causes of Trading Latency

Understanding what causes latency is the first step toward minimizing it. Trading latency isn’t a single bottleneck but rather a series of potential delays that accumulate throughout the order execution process. By identifying each component, you can systematically address the weakest links in your trading infrastructure.

Many traders mistakenly focus on just one aspect of latency—typically their internet connection—while overlooking other significant contributors. A comprehensive approach requires examining the entire signal path from your decision to the exchange and back.

Network Speed and Internet Connection Quality

Your internet connection forms the foundation of your trading infrastructure. Standard residential connections typically offer speeds measured in megabits per second (Mbps), but raw bandwidth tells only part of the story. More critical for trading is connection stability and consistency, measured by ping times and jitter (variation in ping). With the advent of 5G and AI connectivity, traders can expect even greater improvements in network performance.

Fiber optic connections generally offer the lowest latency, followed by cable, then DSL, with satellite and mobile connections typically delivering the highest latency. For serious day traders, a dedicated fiber connection with at least 100 Mbps download/upload speeds and sub-20ms ping times should be considered a minimum requirement. Bandwidth becomes particularly important when streaming multiple real-time data feeds and charts simultaneously.

Order Routing Systems and Their Limitations

After leaving your computer, your order must navigate through your broker’s routing infrastructure before reaching the exchange. This process involves multiple hops and potential queuing delays. Discount brokers typically prioritize cost over speed, often routing orders through multiple intermediaries to capture payment for order flow.

Direct Market Access (DMA) providers eliminate these intermediaries, providing a more direct path to exchanges. The difference can be substantial—industry data suggests standard retail routing adds 50-300ms of latency compared to DMA solutions. For high-frequency strategies, this difference alone can determine profitability.

To explore further, consider reading about the top crypto arbitrage platforms and tools that can be utilized in such strategies.

Broker Server Performance Under Load

Your broker’s server infrastructure significantly impacts execution speed. During market volatility or major news events, order volume spikes can overwhelm inadequately provisioned systems, adding substantial queuing delays. This explains why many retail platforms experience slowdowns precisely when speed becomes most critical—during major market moves.

Enterprise-grade brokers employ load-balanced server farms with redundant connections to exchanges, maintaining consistent performance even during extreme conditions. Budget platforms may struggle during these same periods, leading to order delays, platform freezes, or even outages. These performance differences typically reflect the fee structure—discount brokers save on infrastructure costs but pass the latency penalty to their clients.

Exchange Response Time Variables

Even the exchanges themselves contribute to latency variations. Different venues process orders at different speeds, with some prioritizing certain order types or participant categories. Market centers constantly upgrade their matching engines to process more orders per second, but capabilities still vary significantly.

Physical distance to exchanges also matters enormously. The speed of light through fiber optic cables imposes fundamental limits—approximately 5 microseconds per kilometer. This physics-based constraint explains why high-frequency trading firms pay premium rents for server space physically adjacent to exchange matching engines, a practice known as co-location.

Your Trading Device and Software Configuration

Local hardware and software configuration can introduce substantial latency before your order even leaves your device. Underpowered computers, resource-intensive background applications, and inefficient trading platforms all contribute to pre-transmission delays.

Modern trading platforms can require significant computing resources, particularly when running complex indicators or algorithmic strategies across multiple instruments. RAM, CPU, and storage constraints can add latency spikes during intensive operations. Even display lag from graphics processing can delay visual information by crucial milliseconds, potentially affecting trading decisions based on price action.

How Different Trading Styles Are Affected by Latency

Not all trading approaches have the same latency requirements. Understanding how your specific strategy interacts with execution speed helps prioritize the appropriate technology investments.

High-Frequency Trading: When Nanoseconds Count

In the realm of high-frequency trading (HFT), latency is measured in microseconds (μs) or even nanoseconds (ns). These institutional players execute thousands of trades per second using sophisticated algorithms that identify and exploit fleeting market inefficiencies. For HFT firms, reducing latency from 10 microseconds to 9 microseconds can justify multi-million dollar technology investments.

HFT strategies typically involve pattern recognition across multiple markets, statistical arbitrage, or market making activities that require processing enormous data volumes with minimal delay. These operations necessitate specialized hardware, custom-built low-level programming languages, and direct fiber connections to exchanges. The arms race for speed has reached such extremes that some firms have built microwave transmission towers to gain microsecond advantages over fiber optic connections.

Day Trading: Balancing Speed with Strategy

For active day traders executing multiple intraday positions, latency requirements fall into the millisecond range. While not as extreme as HFT needs, day trading still demands responsive execution, particularly for strategies involving news events, technical breakouts, or short-term momentum plays. Day traders typically need sub-100ms total system latency to avoid significant slippage during active market periods. For those interested in enhancing their trading strategies, exploring the best step-by-step guide to using AI to trade stocks can be beneficial.

Swing Trading: Less Sensitive but Still Important

Swing traders holding positions for days or weeks face less sensitivity to millisecond-level latency but still benefit from reliable execution. For these longer timeframe strategies, consistent order routing and execution are more important than raw speed. Swing traders can generally tolerate several hundred milliseconds of system latency without significant performance impact, provided execution is reliable during entry and exit points.

Measuring Latency in Your Trading Setup

Before you can improve your trading latency, you need to establish baseline measurements and identify bottlenecks. Fortunately, you don’t need sophisticated equipment to conduct basic latency assessments. Simple tools can provide insights into your current system performance.

Think of latency measurement as a diagnostic process similar to a medical checkup. You’re looking for symptoms that might indicate problems requiring attention before they affect your trading performance. Regular testing helps catch degrading performance before it costs you money in missed trades or poor executions.

Simple Tests to Check Your Current Latency

Several free online tools can help assess your network latency. Start with a basic ping test to major financial centers like New York, London, and Tokyo. SpeedTest.net provides both download/upload speeds and ping times to nearby servers. For more specific trading-related tests, brokers often provide connection quality diagnostics within their platforms.

Beyond network tests, monitor your actual order execution times. Most trading platforms log the time difference between order submission and confirmation. Review these logs across different market conditions to identify patterns. A consistent 200ms execution time is preferable to averages that swing wildly between 100ms and 1000ms, as consistency allows you to develop reliable trading tactics even with moderate latency.

Latency Units: Understanding Milliseconds, Microseconds, and Nanoseconds

Trading latency is measured in progressively smaller time units as technology advances. For context, a millisecond (ms) is 1/1000th of a second—the blink of an eye takes about 100-400ms. A microsecond (μs) is 1/1000th of a millisecond, and a nanosecond (ns) is 1/1000th of a microsecond. Most retail traders work in the millisecond range, institutional traders in microseconds, and cutting-edge HFT firms now operate in nanoseconds.

For perspective, light travels about 300 kilometers (186 miles) in a millisecond. This physics-based constraint explains why physical distance to exchanges matters so much for ultra-low-latency trading. No amount of technological optimization can overcome the fundamental speed limit of information transmission.

7 Practical Ways to Reduce Your Trading Latency

While you might not need nanosecond performance, implementing these practical improvements can significantly enhance your trading experience and execution quality.

1. Upgrade Your Internet Connection

Your internet connection forms the foundation of your trading system’s performance. For serious traders, a business-class fiber connection with guaranteed service levels should be considered an investment rather than an expense. Look for connections advertising low ping times rather than just high download speeds. If fiber isn’t available, consider a business-class cable connection with a dedicated IP address to avoid sharing bandwidth during peak usage times.

Connection stability matters as much as raw speed. A consistently performing 100 Mbps connection is preferable to a 1 Gbps connection that experiences intermittent congestion or packet loss. Ask potential providers about their packet loss rates and jitter statistics—metrics that impact trading more than simple bandwidth numbers.

2. Choose the Right Broker for Speed

Not all brokers invest equally in their technological infrastructure. Full-service brokers with higher commissions often provide superior execution quality compared to discount alternatives. Research potential brokers’ execution statistics, which reputable firms publish quarterly under Rule 605/606 reports. These documents reveal average execution times and price improvement metrics that directly reflect latency performance.

Consider testing multiple brokers with small trades during different market conditions before committing significant capital. Pay particular attention to performance during market volatility when execution quality differences become most apparent. Some brokers maintain consistent execution during turbulence while others experience dramatic slowdowns precisely when speed matters most.

3. Optimize Your Trading Computer

Your local hardware can introduce significant latency before orders even leave your device. For active trading, maintain a dedicated computer free from resource-intensive background processes. Minimum specifications should include a modern multi-core processor, 16+ GB of RAM, and solid-state storage. Gaming-grade components often work well for trading applications due to their focus on real-time performance.

Regular system maintenance matters too. Defragment drives, clean registry errors, update drivers, and manage startup programs to prevent performance degradation over time. Consider a fresh operating system installation annually to eliminate accumulated software bloat that gradually impacts responsiveness.

4. Use Wired Instead of Wireless Connections

Wireless connections introduce additional latency and instability compared to wired alternatives. While modern Wi-Fi can achieve impressive speeds under ideal conditions, interference, signal attenuation, and packet retransmissions add unpredictable delays. For critical trading systems, always use a wired Ethernet connection with Cat6 or better cabling directly to your router.

If wireless connections are unavoidable, invest in a high-quality router with the latest standards (Wi-Fi 6 or better) and position it for optimal signal strength. Use the 5GHz band instead of 2.4GHz for less interference, though at the cost of reduced range. Consider wireless extenders or mesh networks for larger spaces rather than accepting weak signals that introduce latency spikes.

5. Consider VPS Solutions

Virtual Private Servers (VPS) located near exchange data centers can dramatically reduce latency compared to residential connections. These cloud-based solutions place your trading platform physically closer to exchanges, bypassing the geographical limitations of your home location. For traders in remote areas or countries distant from major exchanges, VPS solutions can cut hundreds of milliseconds from execution times.

Look for trading-specific VPS providers that optimize for low latency rather than general-purpose hosting. These specialized services often include redundant internet connections, guaranteed CPU resources, and locations specifically chosen for proximity to financial exchanges. Most charge monthly fees based on resources allocated, making them accessible even to retail traders.

6. Switch to Direct Market Access (DMA)

Direct Market Access bypasses traditional order routing systems, connecting you more directly to exchange order books. This approach eliminates intermediary delays and provides greater control over order routing decisions. DMA platforms typically offer advanced order types and greater visibility into market depth, allowing for more sophisticated execution strategies that can partially compensate for residual latency issues.

7. Use Limit Orders During High Volatility

While not reducing latency itself, strategic order types can mitigate its impact. During volatile periods, replace market orders with limit orders to specify maximum purchase prices or minimum selling prices. This approach prevents unexpected executions at unfavorable prices due to latency-induced delays. Though limit orders may sometimes go unfilled if the market moves away quickly, this “missed opportunity” cost is often preferable to guaranteed poor execution from market orders during lag spikes.

For ultra-fast market conditions, consider using bracket orders that simultaneously place your entry along with predefined stop-loss and take-profit levels. This strategy ensures your risk management parameters are already in place before potential latency issues develop, rather than scrambling to enter protective orders after your position is established.

When Latency Matters Most: Market Conditions to Watch

While latency always affects trading performance to some degree, certain market conditions amplify its impact dramatically. Understanding these high-sensitivity periods helps you adapt your trading approach when execution speed becomes most critical. For those interested in exploring advanced strategies, here’s a step-by-step guide to using AI to trade stocks.

News Release Volatility Spikes

Economic data releases, earnings announcements, and central bank decisions create predictable volatility spikes where markets can move significantly in milliseconds. These events represent both opportunity and danger for traders dealing with latency constraints. Major releases like non-farm payrolls, Fed interest rate decisions, or tech company earnings can move markets so quickly that latency-constrained traders see only the aftermath rather than the opportunity.

During these events, order volumes surge across exchanges, compounding latency problems as broker and exchange systems experience peak loads. Many retail platforms that perform adequately during normal conditions develop significant delays precisely when timing becomes most critical. If you routinely trade these events, consider implementing additional latency precautions like pre-positioned limit orders or temporary upgrades to more responsive trading systems.

Opening and Closing Bell Periods

Market opens and closes concentrate enormous trading volumes into compressed timeframes, creating natural latency spikes as systems process order surges. The first and last 30 minutes of trading sessions typically show dramatically higher latency across all trading infrastructures compared to mid-day periods. These effects become even more pronounced during triple witching days or index rebalancing events when institutional activity peaks.

The Future of Trading Latency

Trading latency continues evolving with technological advancement. While once measured in seconds, then milliseconds, today’s cutting edge operates in microseconds and nanoseconds. This progression shows no signs of slowing as competitive advantages drive continued investment in speed. Quantum computing may eventually revolutionize this space, potentially reducing certain computational aspects of trading to near-instantaneous processing.

However, the physics-based constraints of information transmission speed create hard limits that even future technology cannot overcome. Light travels approximately 300 kilometers per millisecond through fiber optic cables, meaning physical distance will always matter regardless of processing improvements. This reality explains the continuing trend toward exchange co-location and the concentration of trading infrastructure in key financial hubs.

- Artificial intelligence is increasingly being deployed to predict and compensate for latency effects

- Blockchain-based trading platforms are exploring decentralized execution models that could democratize latency advantages

- Regulatory frameworks like MiFID II in Europe increasingly require transparency around execution quality and latency impacts

- Neuromorphic computing may eventually enable pattern recognition at speeds that make current latency concerns obsolete

For retail traders, the latency gap with institutional players will likely persist, but continuing technology democratization should gradually improve baseline performance for everyone. The most important development may be increased transparency around latency impacts, empowering traders to make more informed decisions about their technology investments and trading strategies.

Frequently Asked Questions

As you work to optimize your trading system’s performance, these common questions address key aspects of trading latency that often cause confusion.

Is latency the same as slippage in trading?

No, though they’re closely related. Latency is the time delay between initiating an action and its execution, while slippage is the price difference between your expected execution level and what you actually receive. Excessive latency often causes slippage since prices can move during the delay period, but slippage can also occur due to market liquidity issues, volatility, or order size—even with minimal latency.

Think of latency as one potential cause of slippage rather than being synonymous with it. You can experience significant slippage during volatile market conditions even with a low-latency system if you’re trading illiquid instruments or large position sizes relative to available market depth.

How much latency is considered acceptable for retail traders?

Acceptable latency varies by trading style and market conditions. For active day traders in liquid markets like major forex pairs or large-cap equities, total system latency under 100ms generally provides adequate performance for most strategies. Swing traders working on longer timeframes can often tolerate 500ms or more without significant performance impact.

Rather than pursuing arbitrary benchmarks, focus on consistency and reliability. A system that consistently executes within 150-200ms is often preferable to one that averages 75ms but occasionally spikes to 500ms during critical moments. Your latency goals should align with your specific trading timeframe—the shorter your holding periods, the more critical low latency becomes.

For perspective, human reaction time to visual stimuli averages around 200-250ms, meaning many discretionary trading decisions involve inherent delays that dwarf system latency. This explains why algorithmic approaches become increasingly necessary as trading timeframes compress below the minute level.

One practical approach is to measure the average price movement in your traded instruments over different time intervals. If typical price movements during your expected latency period are smaller than your acceptable slippage threshold, your current setup is likely adequate. If not, latency reduction should become a priority.

- High-frequency trading: <1ms (typically requires institutional infrastructure)

- Active day trading: <100ms

- Regular day trading: <200ms

- Swing trading: <500ms

- Position trading: Several seconds may be acceptable

Can trading algorithms compensate for high latency?

Yes, algorithmic strategies can partially mitigate latency disadvantages through predictive modeling and sophisticated order types. While algorithms cannot eliminate fundamental transmission delays, they can employ statistical methods to anticipate price movements and adjust order parameters accordingly. Some algorithms specifically model market impact and latency effects to optimize entry and exit timing even with known execution delays.

Advanced execution algorithms might split larger orders into optimally sized child orders, time submissions to coincide with favorable liquidity conditions, or employ passive-aggressive switching logic based on real-time market conditions. These approaches don’t eliminate latency but can significantly reduce its negative impacts on trading performance.

Does latency affect cryptocurrency trading differently than stock trading?

Cryptocurrency markets typically involve higher inherent latency than traditional exchanges due to blockchain confirmation times and less mature infrastructure. While stock exchanges process transactions in microseconds, crypto transactions often require multiple confirmations that can take minutes or even hours depending on network congestion. This fundamental difference creates a distinct latency profile for crypto trading.

However, for exchange-based crypto trading (rather than on-chain transactions), many of the same latency considerations apply. Major crypto exchanges have been rapidly improving their infrastructure, with some now approaching the performance of traditional financial markets. The primary difference lies in the greater variability of latency in crypto markets during periods of extreme volatility or network congestion.

Are mobile trading apps more prone to latency issues?

Yes, mobile trading platforms typically experience higher and more variable latency than desktop alternatives. This increased latency stems from multiple factors: cellular data networks add transmission delays compared to wired connections; mobile devices prioritize power efficiency over performance; and mobile apps are often simplified versions of their desktop counterparts with fewer optimization options.

For critical trading activities, desktop platforms connected via wired networks remain the gold standard for performance. However, mobile technology continues advancing rapidly, with 5G networks and increasingly powerful mobile processors narrowing the gap. Modern mobile trading apps can provide adequate performance for monitoring positions and occasional trading, though they remain suboptimal for latency-sensitive strategies or high-frequency execution.

If you must use mobile trading, connect to reliable Wi-Fi rather than cellular networks when possible, close background applications to maximize available resources, and consider limit orders rather than market orders to control execution prices during potential latency spikes.

Join the Conversation