Key Takeaways

- The SAVE Plan reduces undergraduate loan payments to 5% of discretionary income and offers forgiveness in as little as 10 years.

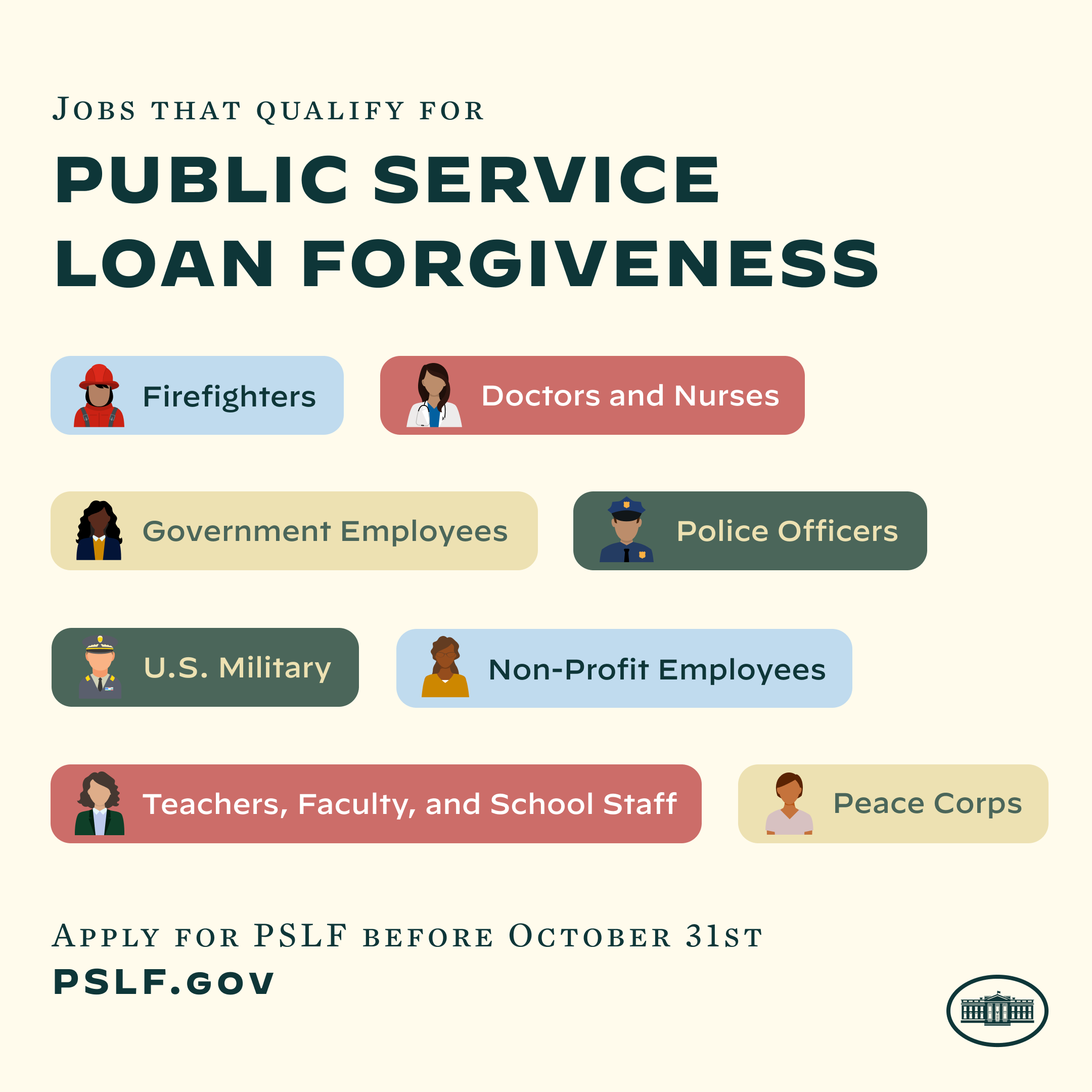

- Public Service Loan Forgiveness (PSLF) 2026 now includes automatic payment counting and digital employer verification.

- Income-driven repayment forgiveness remains available after 20–25 years, with tax-free benefits through at least December 2025.

- Only federal Direct Loans qualify—always confirm eligibility on StudentAid.gov.

- All legitimate student loan forgiveness programs are free to apply for; never pay upfront fees.

“student loan forgiveness in Wisconsin …” from www.dailycardinal.com and used with no modifications.

If you’re one of the 43 million Americans carrying federal student loan debt, 2026 could be your breakthrough year. The financial burden of monthly student loan payments that feel like a second rent payment has prompted significant policy changes. Student loan forgiveness in 2026 have expanded dramatically since 2024, creating more pathways to eliminate your debt completely. Student Loan Borrower Assistance provides free resources to navigate these complex options without falling prey to scams.

Your Path to $0 Balance: New Forgiveness Options for 2026

The student loan landscape has transformed dramatically in the last two years. With finalized updates to the SAVE Plan, expanded PSLF pathways, and streamlined forgiveness applications, millions of borrowers previously denied relief now qualify. The complex web of requirements has been simplified, and automatic data-matching between government agencies has eliminated many of the paperwork headaches that once plagued these programs.

Why More Borrowers Now Qualify for Complete Loan Forgiveness

The Department of Education has made significant changes to broaden eligibility for student loan forgiveness in 2026. These updates correct historical issues where borrowers were placed in the wrong repayment plans, received incorrect information from loan servicers, or had qualifying payments miscounted. The PSLF Data Match initiative automatically identifies qualifying employment periods by cross-referencing federal employment databases, eliminating the need for annual certification in many cases. Additionally, the IDR Account Adjustment granted retroactive credit for past periods of forbearance and deferment that previously didn’t count toward forgiveness timelines.

For millions of borrowers, these changes have shaved years off their forgiveness timelines. Some have even discovered they’ve already met the requirements for complete loan forgiveness, particularly those in public service who struggled with the previously rigid PSLF requirements.

The New SAVE Plan Changes That Cut Monthly Payments

- Undergraduate loan payments reduced from 10% to just 5% of discretionary income

- Graduate loan payments remain at 10% of discretionary income

- Higher income exemption threshold (225% of federal poverty line vs previous 150%)

- Interest subsidies prevent balances from growing when payments don’t cover interest

- Shorter forgiveness timeline for smaller balances (10 years for borrowers with original balances under $12,000)

The SAVE Plan represents the most significant overhaul of income-driven repayment since these plans were created. For a family of four with an income of $75,000 and $30,000 in undergraduate student loan debt, monthly payments have dropped from approximately $265 under older plans to just $94 under SAVE. More importantly, unlike previous income-driven plans where unpaid interest could balloon your balance, the SAVE Plan’s interest subsidy prevents negative amortization as long as you make your required payments.

If you’re dealing with other forms of debt, you might want to explore options with top debt settlement companies to manage your financial health effectively.

This revolutionary approach means borrowers can make affordable payments without watching their balances grow larger each month. For those with modest incomes but high debt burdens, this change transforms student loans from a lifelong burden into a manageable expense with a clear end date.

PSLF Expansion: Who Benefits Most

The Public Service Loan Forgiveness program has been revamped to automatically credit millions of public servants with previously uncounted qualifying payments. Teachers, nurses, military personnel, government employees, and nonprofit workers have seen dramatic improvements in how their service is counted toward the 120-payment requirement. The most significant change is the automatic employer verification system that has replaced the cumbersome annual certification process for many federal and state employees. Additionally, temporary periods of leave, including parental leave and medical leave, now count toward the 10-year service requirement, acknowledging that careers in public service often include these necessary breaks.

7 Legit Student Loan Forgiveness Programs in 2026 (Official + Verified)

All programs listed below are administered by the U.S. Department of Education or its authorized servicers. No private companies can “approve” your forgiveness—only the federal government has this authority. Each program has specific eligibility requirements and application procedures, but all share one critical feature: they’re completely free to apply for through official government channels.

1. Public Service Loan Forgiveness (PSLF) — For Government & Nonprofit Workers

“student loan forgiveness …” from x.com and used with no modifications.

PSLF remains the gold standard of forgiveness programs, offering complete loan elimination after 10 years of public service. Full-time employees (at least 30 hours weekly) of government organizations (federal, state, local, tribal) or 501(c)(3) nonprofits qualify for this program regardless of their role within the organization. The program requires 120 qualifying monthly payments, but these need not be consecutive, allowing for career changes and breaks in service.

The 2026 update introduced a digital verification system that automatically identifies qualifying employers, eliminating the paperwork burden for many borrowers. PSLF remains restricted to Direct Loans, so borrowers with FFEL or Perkins loans must consolidate into a Direct Consolidation Loan to qualify. The PSLF Help Tool now auto-fills employer information and flags missing payments, streamlining the application process significantly.

“After 10 years as a public school teacher, my remaining $38,000 was forgiven completely. I submitted my final form in January and by March, my balance showed zero. PSLF quite literally changed my life.” — Maria G., Austin, TX

2. SAVE Plan — For Low-to-Middle Income Borrowers

“Pros And Cons Of The SAVE Plan — What …” from www.creditassociates.com and used with no modifications.

The SAVE Plan (Saving on a Valuable Education) has replaced the outdated REPAYE plan, offering substantially lower payments and faster forgiveness timelines. For undergraduate loans, payments are capped at just 5% of discretionary income, compared to 10% under previous plans. Graduate loans remain at 10% of discretionary income, while borrowers with both undergraduate and graduate loans pay a weighted average between 5-10%. The most revolutionary aspect of SAVE is the income threshold—borrowers earning below 225% of the federal poverty line qualify for $0 monthly payments that still count toward forgiveness.

Forgiveness timelines under SAVE are significantly shortened compared to other income-driven plans. Borrowers with original balances under $12,000 can receive forgiveness after just 10 years of payments, with each additional $1,000 borrowed adding one year to the timeline (maxing out at 20-25 years). Perhaps most importantly, the 2026 enhancement includes an “Interest Subsidy” that prevents balances from growing when calculated payments don’t cover accruing interest—a game-changer for borrowers with high balances relative to their income.

3. Teacher Loan Forgiveness — For K–12 Educators

“Teacher Loan Forgiveness – Student Loan …” from educatorfi.com and used with no modifications.

Dedicated specifically to K-12 educators serving in high-need areas, Teacher Loan Forgiveness provides $5,000-$17,500 in forgiveness after five complete, consecutive years of teaching. To qualify, teachers must work full-time in low-income schools (Title I) or educational service agencies serving low-income students. While general teachers receive $5,000 in forgiveness, those who teach mathematics, science, or special education at the secondary level can receive up to $17,500.

The program covers Direct Subsidized/Unsubsidized, FFEL, and Perkins Loans, making it more flexible than PSLF in terms of loan eligibility. However, teachers should note that the same five years of service cannot be counted toward both Teacher Loan Forgiveness and PSLF simultaneously. For most teachers, calculating which program provides greater benefit is essential, as PSLF typically offers more substantial relief for those with higher debt loads.

4. Income-Driven Repayment (IDR) Forgiveness — For Long-Term Relief

“Income-Driven Repayment Plan: IDR …” from www.debt.com and used with no modifications.

All income-driven repayment plans (SAVE, PAYE, IBR, and ICR) offer eventual forgiveness after a set number of qualifying payments. The forgiveness timeline varies by plan, with SAVE offering the shortest path at 20-25 years for most borrowers (or potentially just 10 years for those with smaller balances). While this forgiveness timeline is longer than PSLF, it doesn’t require public service employment, making it accessible to all federal loan borrowers regardless of career choice. If you’re exploring options to manage your finances, you might also consider top debt settlement companies for additional support.

Currently, forgiveness received under IDR plans is tax-free through December 31, 2025, thanks to a provision in the American Rescue Plan. Legislation is pending to extend this tax-free status permanently, though borrowers should stay informed about potential tax implications for forgiveness received after this date. The 2024-2025 IDR Account Adjustment granted retroactive credit for past forbearance, deferment, and non-IDR payment periods, accelerating forgiveness timelines for millions of borrowers.

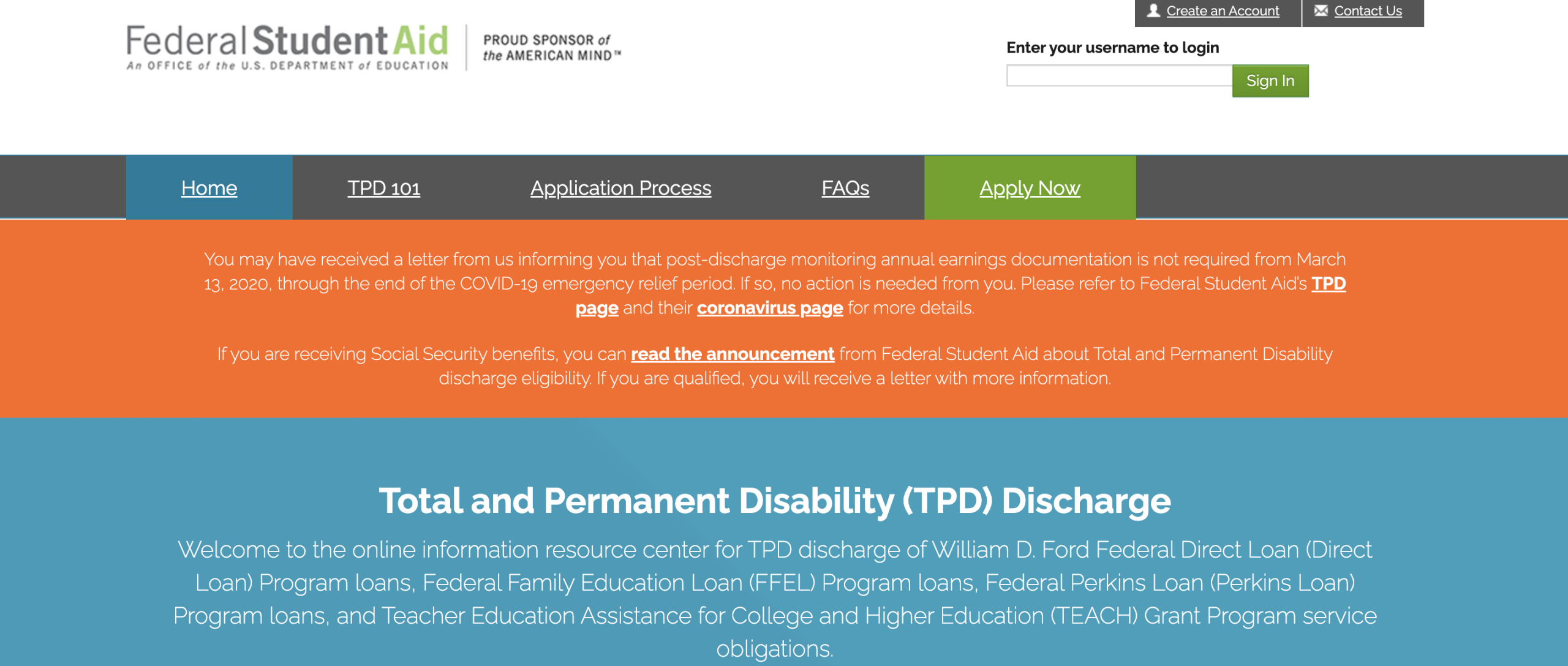

5. Total and Permanent Disability Discharge — For Borrowers Unable to Work

“Total & Permanent Disability (TPD …” from studentloanborrowerassistance.org and used with no modifications.

Borrowers who develop a total and permanent disability may qualify for complete loan discharge. Eligibility can be established through certification from the Social Security Administration, Department of Veterans Affairs, or a physician. The streamlined process now automatically identifies many eligible borrowers through data matching with other federal agencies, eliminating application requirements for those already identified as permanently disabled in government databases.

Nelnet serves as the dedicated TPD servicer, processing applications and documentation for this program. While traditionally a 3-year income monitoring period followed discharge approval, this requirement is now waived for borrowers qualifying through SSA or VA determination. Importantly, discharged amounts under this program are not considered taxable income, providing complete financial relief without tax consequences.

6. Closed School Discharge — For Students Whose School Shut Down

“Closed School Discharge – Student Loan …” from studentloanborrowerassistance.org and used with no modifications.

Students enrolled when their school closed, or who withdrew within 180 days of closure, may qualify for complete loan discharge. The Department of Education has implemented automatic discharge for students from over 400 closed institutions since 2015, eliminating the need for individual applications in many cases. For schools that closed before automatic discharge was implemented, borrowers must submit an application through their loan servicer.

The discharge covers all federal loans taken for attendance at the closed school, including Direct Loans, FFEL Program loans, and Perkins Loans. Unlike some other relief programs, Closed School Discharge carries no public service requirement or payment count threshold—eligibility is based entirely on the school’s closure and the student’s enrollment timeline.

7. Borrower Defense to Repayment — For Victims of School Fraud

“Borrower Defense to Repayment Update …” from www.youtube.com and used with no modifications.

Students misled or defrauded by their educational institution may qualify for partial or complete loan forgiveness through Borrower Defense to Repayment. Common qualifying circumstances include false job placement statistics, misrepresentation of program accreditation, or deceptive promises about credit transferability. The application requires documentation detailing the school’s misconduct and how it affected enrollment decisions.

Recent settlements have provided complete discharge for borrowers from notorious institutions like Corinthian Colleges, ITT Technical Institute, and DeVry University. The Department of Education has implemented group discharges for entire cohorts from these and other fraudulent institutions, automatically providing relief without individual applications. For schools not covered by group discharge determinations, borrowers must submit individual claims through the StudentAid.gov Borrower Defense application.

| Program | Forgiveness Timeline | Qualifying Loans | Key Requirements |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 10 years (120 payments) | Direct Loans only | Employment with government or 501(c)(3) nonprofit |

| SAVE Plan | 10-25 years | Direct Loans | Income-driven payments |

| Teacher Loan Forgiveness | 5 years | Direct, FFEL | Teaching at qualifying low-income school |

| Total and Permanent Disability | Immediate upon approval | All federal loans | Documentation of disability |

Step-by-Step: How to Apply for Forgiveness (PSLF Example)

- Gather your FSA ID login credentials

- Compile employment records for all qualifying employers

- Verify your loan types (only Direct Loans qualify)

- Ensure you’re on an income-driven repayment plan

- Download the PSLF Help Tool results for your records

While each forgiveness program has its own application process, PSLF remains the most commonly pursued and historically confusing option. The process has been significantly streamlined in 2026, but still requires careful attention to detail. Following these steps exactly will help you avoid the common pitfalls that once delayed or denied forgiveness for thousands of public servants.

The application process now leverages digital tools that automatically cross-reference employment data across government databases, eliminating many of the paperwork burdens that plagued earlier applicants. For most federal employees, employment verification now occurs automatically through database matching rather than requiring annual certification forms.

Remember that forgiveness is not automatic upon reaching 120 qualifying payments—you must submit a final application through the PSLF Help Tool to trigger the forgiveness review process. Many borrowers reach eligibility without realizing it, so regular monitoring of your payment count is essential.

Step 1: Access Your StudentAid.gov Account

Begin by logging in to StudentAid.gov using your FSA ID. If you don’t already have an FSA ID, you’ll need to create one through the Federal Student Aid website. This digital credential serves as your legal signature for federal student aid documents and is essential for accessing all Department of Education loan services.

Once logged in, navigate to the “My Aid” section to view all your federal student loans. Pay careful attention to the loan types listed—only Direct Loans qualify for PSLF. If you have FFEL or Perkins loans, you’ll need to consolidate them into a Direct Consolidation Loan before those periods of service can count toward forgiveness.

Next, verify your current repayment plan. Only payments made under income-driven repayment plans (SAVE, PAYE, IBR, or ICR) qualify for PSLF. If you’re on the Standard 10-Year plan, your payments count toward PSLF, but you’ll pay off your loans before reaching forgiveness unless you switch to an income-driven plan.

Download your loan details for your records, as you may need this information during the application process. This documentation provides important reference points if discrepancies arise during your forgiveness review.

PSLF Eligibility Checklist

- ✓ Direct Loans only (or consolidated into Direct)

- ✓ Employed full-time (30+ hours) by qualifying employer

- ✓ 120 qualifying monthly payments (not necessarily consecutive)

- ✓ Income-driven repayment plan (or 10-Year Standard)

- ✓ On-time payments (within 15 days of due date)

Step 2: Navigate the PSLF Help Tool

The PSLF Help Tool has replaced the old paper application system entirely. Access it directly through StudentAid.gov/pslf and follow the guided process. The tool automatically pulls your loan information and pre-fills your personal details, saving significant time and reducing errors. When searching for your employer, use the official employer name as registered with the IRS or the Employer Identification Number (EIN) for most accurate results. If your employer is already in the database and verified as qualifying, you’ll be able to digitally complete the form without obtaining physical signatures in many cases.

Step 3: Track Your Application Through MOHELA

After submitting through the PSLF Help Tool, your application is transferred to MOHELA, the dedicated PSLF loan servicer. You’ll receive an email confirmation from MOHELA within 5-7 business days, and your loans may be transferred to MOHELA if they’re currently with another servicer. This transfer doesn’t reset your payment count or affect your eligibility.

Create an account on MOHELA.com to track your application status in real-time. The dashboard displays your current qualifying payment count, pending employment certifications, and estimated forgiveness date based on your current progress. MOHELA typically processes applications within 60-90 days, though this timeline can vary during high-volume periods.

Step 4: What to Do If Your Application Is Denied

If your application is denied or your payment count seems incorrect, don’t panic—many initial denials are overturned on appeal. Begin by reviewing the specific reason for denial provided in your determination letter. Common reasons include missing employer information, ineligible loan types, or insufficient documentation of full-time status.

The reconsideration process allows you to submit additional documentation addressing the specific deficiency in your application. For employment verification issues, submit pay stubs, W-2 forms, or employment contracts demonstrating your qualifying employment. For payment count discrepancies, provide bank statements or payment confirmations showing on-time payments during the disputed periods.

Common PSLF Application Mistakes to Avoid

Most PSLF denials result from preventable errors in the application process. Avoid the four most common pitfalls: submitting incomplete employment certification (missing dates or signatures), failing to recertify income annually for income-driven repayment plans, making late payments (more than 15 days past due), and assuming part-time work at multiple qualifying employers automatically constitutes full-time status (you must document at least 30 hours weekly combined). Submit your employment certification annually rather than waiting until you reach 120 payments—this creates a verified record of your qualifying employment and prevents surprises when you apply for final forgiveness.

Forgiveness Scams to Avoid in 2026 (Red Flags)

Student loan forgiveness scams have proliferated as legitimate forgiveness options expand. Remember this critical fact: the Department of Education never charges fees to apply for forgiveness. If any company requests payment to process your forgiveness application, it’s a scam, plain and simple. Legitimate assistance is available for free through your loan servicer and nonprofit consumer advocacy organizations.

Scammers are becoming increasingly sophisticated, creating professional websites and social media campaigns that mimic official government communications. Some even claim to be “pre-approved” by the Department of Education or to have special relationships with loan servicers that expedite forgiveness approval.

Fake Companies Charging Upfront Fees

The most common scam involves companies charging hundreds or even thousands of dollars in “processing fees” to complete forgiveness applications. These predatory operators often promise to “qualify” you for special forgiveness programs or claim they can negotiate settlements with your loan servicer. In reality, they simply complete the same free government forms you can access yourself, often submitting inaccurate information that delays or disqualifies your application.

If you’re looking to improve your financial situation, consider exploring credit repair services as a legitimate option.

These companies frequently operate on a subscription model, charging monthly fees to “monitor” your forgiveness progress without providing any valuable service. Some even take it further by requesting your FSA ID login credentials, which gives them full access to your loan accounts and personal information. Never share your FSA ID with any third party—this is your legal signature for federal student aid.

False “Guaranteed Approval” Promises

No legitimate organization can guarantee your forgiveness application will be approved. Eligibility is determined solely by the Department of Education based on specific criteria that vary by program. Companies advertising “guaranteed approval” or claiming they have “pre-approved” borrowers for forgiveness are misrepresenting their services and likely setting you up for disappointment.

Similarly, beware of companies claiming to offer “new” or “exclusive” forgiveness programs not mentioned on government websites. All legitimate forgiveness programs are fully documented on StudentAid.gov—there are no secret or exclusive programs available only through private companies. If the program isn’t described on official government websites, it doesn’t exist.

Lookalike Websites That Steal Your Information

Sophisticated scammers create websites that mimic official government sites, using similar domain names, logos, and language to appear legitimate. These sites often have URLs like “StudentLoanForgiveness.com” or “PSLF-Application.org” that seem official but aren’t connected to the Department of Education. The only legitimate website for federal student loan information and applications is StudentAid.gov—all other sites should be approached with extreme caution.

These imposter websites collect your personal and financial information, ostensibly to complete forgiveness applications. In reality, they’re harvesting data for identity theft or selling your contact information to marketing firms. Some even install tracking cookies or malware on your device when you visit, creating additional security vulnerabilities.

How to Report Student Loan Scams

If you encounter a student loan forgiveness scam, report it immediately to protect yourself and others. File complaints with the Federal Trade Commission at ReportFraud.ftc.gov and the Department of Education’s Office of Inspector General Hotline at 1-800-MIS-USED (1-800-647-8733). For financial scams involving payment, also report to the Consumer Financial Protection Bureau through ConsumerFinance.gov/complaint. These agencies actively investigate reported scams and can take enforcement action against fraudulent companies.

What If You Don’t Qualify for Forgiveness? 3 Smart Alternatives

Not everyone will qualify for student loan forgiveness in 2026, especially those with private student loans or those who don’t meet the specific requirements of federal forgiveness programs. Fortunately, several alternative strategies, such as exploring the best credit repair services, can help make your student loan burden more manageable while you work toward eventual payoff or forgiveness eligibility.

1. Refinancing: When It Makes Sense (And When It Doesn’t)

Refinancing involves a private lender paying off your existing student loans and issuing a new loan with different terms—ideally a lower interest rate. This option is best for borrowers with private loans or federal loans who have excellent credit (typically 700+ score) and stable, high income. The primary benefit is potential interest savings, which can be substantial for large loan balances. For example, refinancing $60,000 in loans from 7% to 4.5% could save over $10,000 in interest over a 10-year term.

However, refinancing federal loans carries significant drawbacks. You permanently lose access to all federal benefits, including income-driven repayment plans, forgiveness programs, and hardship protections like deferment and forbearance. This trade-off rarely makes financial sense for borrowers pursuing PSLF or those who might need income-driven options in the future. A good rule of thumb: only refinance federal loans if you’re certain you won’t need federal protections and the interest savings are substantial enough to justify the permanent loss of benefits.

2. Income-Driven Repayment: Lower Payments Now

Income-driven repayment plans can provide immediate relief from high monthly payments even if forgiveness is years away. These plans cap your monthly payment at a percentage of your discretionary income, regardless of your loan balance, making them particularly valuable for borrowers with high debt-to-income ratios. The SAVE Plan offers the most favorable terms for most borrowers, with undergraduate loan payments capped at just 5% of discretionary income and interest subsidies preventing balance growth.

Even if you’re not pursuing forgiveness, income-driven plans provide valuable flexibility during financial hardship or career transitions. Your payments adjust automatically based on income changes, providing a safety net during periods of reduced earnings. Additionally, payments made under these plans count toward eventual forgiveness after 20-25 years, creating a definite end date for your loan obligations regardless of the balance.

3. Deferment or Forbearance: Emergency Options

Deferment and forbearance are short-term emergency tools that temporarily pause your payment obligations during periods of financial hardship. Deferment offers the additional benefit that interest may not accrue on subsidized loans during the pause period. These options should be used sparingly and strategically, as they can significantly increase your total repayment amount through accumulated interest and extended timelines. For those facing financial challenges, considering debt settlement companies might also be a viable alternative to explore.

Most borrowers are better served by income-driven repayment plans, which can reduce payments to as low as $0 during financial hardship while still counting toward forgiveness timelines. Reserve deferment and forbearance for genuine emergencies like medical crises or temporary unemployment when you need a complete payment pause. Remember that periods in deferment or forbearance generally don’t count toward forgiveness timelines, though some exceptions exist for military service and economic hardship deferments.

Your Next Steps: Simple Action Plan for Loan Relief

Navigating student loan forgiveness in 2026 doesn’t have to be overwhelming. Break down the process into manageable steps, starting with understanding your current loan portfolio and identifying which forgiveness programs align with your career path and financial situation. The steps below provide a clear roadmap regardless of where you are in your repayment journey. For those looking to improve their financial standing, exploring credit repair services might be beneficial.

Document Checklist: What You’ll Need to Apply

- Your FSA ID login credentials

- Complete loan summary (printout from StudentAid.gov)

- Recent tax returns and pay stubs for income verification

- Employment certification for all qualifying employers (PSLF)

- Dates of employment and employer EIN numbers

- Documentation of any previous payments not reflected in your account

Begin by organizing these documents in a dedicated folder, either physical or digital. Many forgiveness delays and denials stem from incomplete documentation, so thorough preparation significantly improves your chances of approval. Keep copies of everything you submit, including confirmation numbers and correspondence with loan servicers.

Consider creating a forgiveness journal that tracks all your interactions with loan servicers, including dates, representative names, and summaries of conversations. This documentation can prove invaluable if discrepancies arise during your application review.

For PSLF applicants, maintaining a comprehensive employment history with exact start and end dates for all qualifying employers is crucial. The PSLF Help Tool will prompt you for this information, and having it ready streamlines the application process significantly.

Critical Deadlines You Can’t Afford to Miss

Several time-sensitive opportunities require immediate attention from borrowers seeking forgiveness. The IDR Account Adjustment, which retroactively credits certain forbearance and deferment periods toward forgiveness, has a final implementation deadline in December. Similarly, borrowers who benefited from payment pauses during the COVID-19 emergency should verify that these months have been properly counted toward their forgiveness progress, as this credit could accelerate forgiveness timelines by nearly three years.

For income-driven repayment plans, annual recertification deadlines are critical. Missing these deadlines can result in capitalized interest, higher payments, and delays in forgiveness progress. Set calendar reminders for these annual milestones, typically occurring either on a fixed annual date or on the anniversary of your enrollment in the plan. The SAVE Plan specifically requires annual income recertification, with automatic increases to maximum payments if documentation isn’t received by the deadline.

Free Resources That Actually Help

Skip paid “consultants” and instead utilize legitimate free resources that provide expert guidance on forgiveness options. The Federal Student Aid Information Center (1-800-4-FED-AID) offers personalized assistance from trained specialists who can answer complex questions about forgiveness eligibility and application processes. For specialized needs, connect with nonprofit organizations like the Student Borrower Protection Center, National Consumer Law Center, or Institute of Student Loan Advisors, which provide free educational resources and guidance without charging fees or collecting commissions.

Frequently Asked Questions (FAQs)

Navigating student loan forgiveness often raises specific questions about eligibility, application processes, and long-term implications. The answers below address the most common questions borrowers have about 2026 forgiveness programs, with clear, definitive information based on current Department of Education guidelines.

Remember that while general guidelines apply to most situations, individual circumstances may affect your specific eligibility or optimal strategy. When in doubt, contact your loan servicer directly or consult with a nonprofit student loan advisor for personalized guidance tailored to your unique situation.

Many borrowers miss forgiveness opportunities simply because they don’t ask the right questions or explore all available options. Don’t assume you’re ineligible based on past denials or general information—the forgiveness landscape has changed dramatically in recent years, creating new pathways even for borrowers previously told they didn’t qualify.

Is Student Loan Forgiveness in 2026 Taxable?

Student loan forgiveness received through December 31, 2025, is not taxable at the federal level, thanks to a provision in the American Rescue Plan Act. This tax-free status applies to all federal forgiveness programs, including PSLF, income-driven forgiveness, and disability discharges. For forgiveness received after this date, the tax implications remain uncertain as Congress considers extending this provision. If you’re dealing with other financial obligations, you might want to explore top debt settlement companies for additional support.

State taxation varies significantly. While most states conform to federal tax treatment, some may still consider forgiven student loan debt as taxable income even when it’s exempt at the federal level. Consult with a tax professional familiar with your state’s specific regulations to understand potential state tax obligations for forgiveness received in 2026. For a broader understanding of financial implications, you might also explore debt settlement companies that can provide guidance on managing forgiven debts.

If forgiveness does become taxable after 2025, the tax liability would be based on your ordinary income tax rate applied to the forgiven amount. For example, if $50,000 in loans is forgiven and you’re in the 22% tax bracket, you could owe approximately $11,000 in federal taxes. Planning ahead for this potential tax liability is wise, perhaps by establishing a dedicated savings account to cover the eventual obligation.

Tax Planning Tip: Even if forgiveness becomes taxable after 2025, the tax impact would be based on your income in the year forgiveness is received—not your current income. If possible, consider strategies to reduce other income during your expected forgiveness year to minimize the tax impact.

Can Parent PLUS Loans Be Forgiven?

Yes, Parent PLUS loans can be forgiven, but the pathways are more limited than for other federal student loans. The primary route is through the Public Service Loan Forgiveness program after consolidating into a Direct Consolidation Loan and enrolling in the Income-Contingent Repayment (ICR) plan. Parent borrowers must work full-time for a qualifying employer while making 120 qualifying monthly payments. Importantly, it’s the parent’s employment that matters for PSLF eligibility, not the student’s.

- Consolidation is mandatory for PLUS loans seeking forgiveness

- Only ICR is available for consolidated Parent PLUS loans (not SAVE, PAYE, or IBR)

- Double Consolidation strategy can potentially lower payments (consult a specialist)

- Parent’s employment (not student’s) determines PSLF eligibility

Outside of PSLF, Parent PLUS loans are eligible for forgiveness through Total and Permanent Disability Discharge if the parent borrower becomes disabled. However, the student’s disability does not qualify the parent for discharge. Parent PLUS loans are also eligible for discharge if the school closed while the student was enrolled or shortly after withdrawal.

Monthly payments under ICR are typically higher than other income-driven plans, calculated as 20% of discretionary income or the amount needed to pay off the loan in 12 years, whichever is less. For parents with high incomes relative to their loan balance, this may result in payments that would fully repay the loan before reaching forgiveness eligibility.

What If I Already Paid Off My Loans?

If you’ve already paid off your federal student loans, you may still be eligible for a refund under specific circumstances. Borrowers who made voluntary payments during the COVID-19 payment pause (March 13, 2020, through September 30, 2023) can request refunds of those payments through their loan servicer. This applies even if those payments fully satisfied the loan balance during the pause period. For example, if you paid $10,000 toward your loans during the pause and this completely paid off your balance, you could potentially request a refund, effectively “reopening” your loans.

Outside of COVID-related refunds, borrowers who discover they were eligible for forgiveness programs but continued making payments past their qualification date may request retroactive forgiveness and refunds of overpayments. This most commonly occurs with PSLF when borrowers realize they reached 120 qualifying payments months or even years before applying. If approved, payments made after the 120th qualifying payment are refunded. However, this option doesn’t apply to loans that were fully paid off through regular payments before a forgiveness application was submitted.

How Long Does Forgiveness Approval Take?

Forgiveness approval timelines vary significantly by program, but most applications are processed within 60-90 days of submission. PSLF applications typically take 60-90 days for review and approval once a complete application is received by MOHELA. Applications with missing information or requiring employment verification may take longer. Total and Permanent Disability discharge applications are typically processed within 30 days, while Borrower Defense claims may take significantly longer—sometimes 6-12 months—due to the investigative nature of these claims.

Do $0 Monthly Payments Count Toward Forgiveness?

Yes, months when your calculated payment under an income-driven repayment plan is $0 absolutely count toward both PSLF and IDR forgiveness timelines. These $0 payments are legitimate qualifying payments when they result from your income falling below the payment threshold (currently 225% of the federal poverty line under the SAVE Plan). Many borrowers mistakenly believe they must make actual dollar payments for the month to count, but this is incorrect.

This policy creates a valuable opportunity for borrowers experiencing income reduction due to career changes, family leave, or educational pursuits. Periods of lower income can accelerate your progress toward forgiveness while maintaining your loans in good standing. For example, a teacher who takes an unpaid summer break or reduced hours might qualify for $0 payments during those months, all of which count toward their forgiveness timeline.

The key distinction is that these must be calculated $0 payments under an income-driven plan, not months in deferment or forbearance (which generally don’t count toward forgiveness). Make sure your $0 payment is officially calculated and confirmed by your servicer through annual income certification to ensure these months count toward your forgiveness progress.

Student Loan Borrower Assistance provides comprehensive resources to help you navigate all available forgiveness options, ensuring you don’t miss opportunities to eliminate your student debt completely.

Join the Conversation