Key Takeaways: Best B2B Marketplaces 2026

- Global B2B marketplace GMV will surpass $4 trillion by 2026—a 35% jump from 2023.

- 87% of top platforms now use AI-powered matchmaking for smarter supplier discovery.

- Industry-specific marketplaces (e.g., healthcare, construction) are outpacing general ones.

- Regional platforms in emerging markets are growing 40–60% annually.

- Companies using multiple B2B marketplaces achieve 28% more supplier diversity and 23% better pricing.

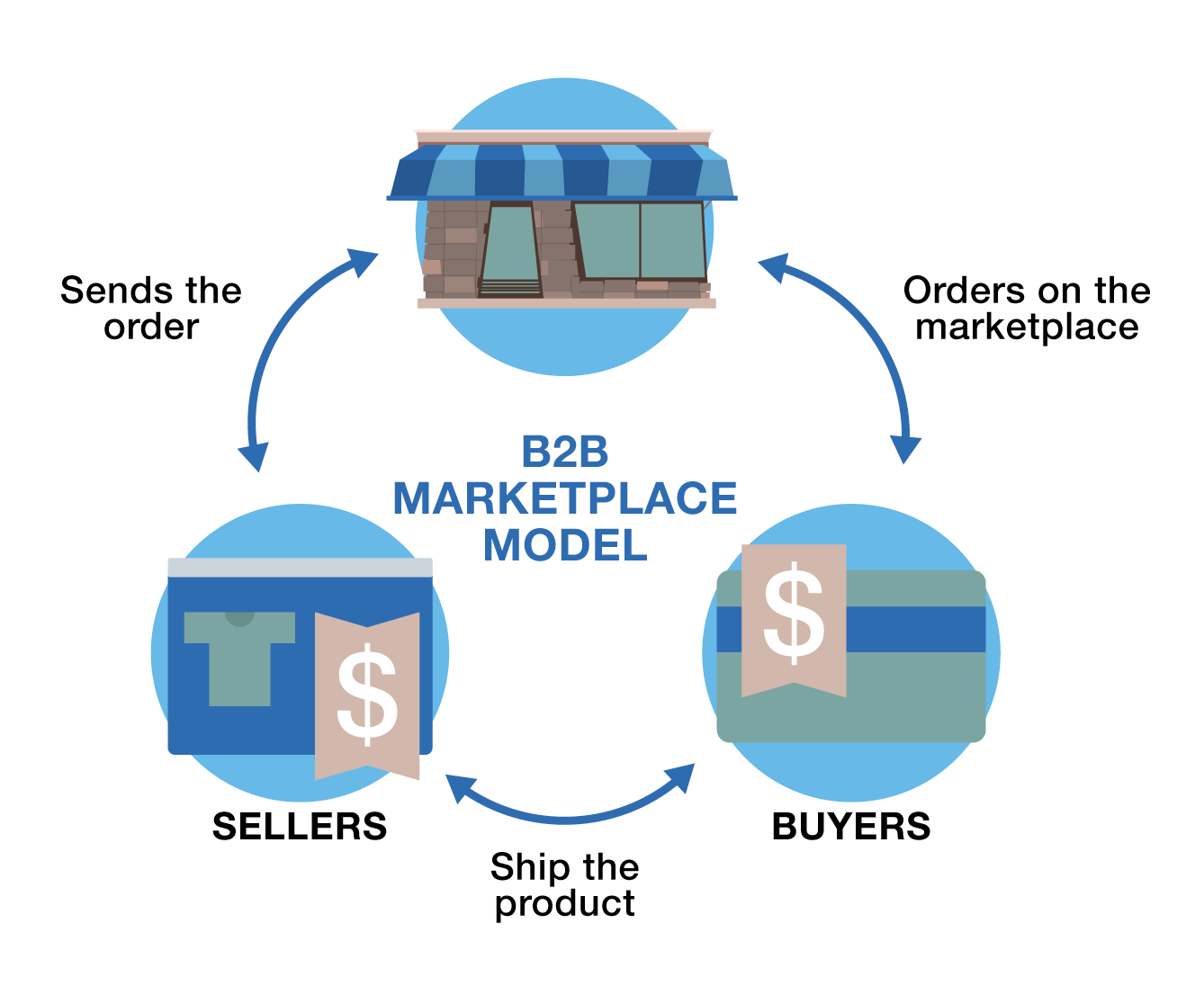

“The 3 Most Common B2B Marketplace …” from www.journeyh.io and used with no modifications.

B2B Marketplace Revolution: What You Need to Know for 2026

The B2B marketplace landscape is undergoing a seismic shift that will fundamentally transform how businesses connect and trade by 2026. With global B2B e-commerce transactions projected to exceed $25.65 trillion by 2026, digital marketplaces have become the central nervous system of global commerce. Market Business Watch analysis reveals that companies embracing these platforms are achieving 40% faster supplier discovery and 32% cost reductions compared to traditional procurement methods.

This transformation isn’t merely about digitizing existing processes—it’s about reimagining the entire business ecosystem. The most successful companies in 2026 will be those that leverage these platforms not just as purchasing channels but as strategic assets that provide competitive intelligence, relationship management tools, and access to previously untapped markets.

The Explosive Growth of B2B Platforms

B2B Marketplace Growth Trajectory 2023-2026

The global GMV: $2.97T (2023) → $4.01T (2026)

Active Business Users: 85M (2023) → 127M (2026)

Average Transaction Value: $4,250 (2023) → $5,780 (2026).

Mobile Transaction %: 38% (2023) → 61% (2026)

Source: McKinsey Digital Commerce Analysis, 2023

The statistics tell a compelling story of accelerated adoption. B2B marketplaces have witnessed a compound annual growth rate of 18.4% since 2021, far outpacing traditional distribution channels. This surge is driven by several converging factors: pandemic-accelerated digitization, generational leadership shifts in procurement roles, and significant advancements in platform technologies that make integration and operation increasingly seamless.

What’s particularly notable is the democratization effect. While enterprise-level organizations dominated early B2B marketplace adoption, we’re now seeing mid-market and even small businesses leveraging these platforms to compete globally. A business in Omaha can now source components from Shenzhen with the same efficiency as a multinational corporation, fundamentally altering competitive dynamics across virtually every industry.

The network effects are becoming increasingly powerful. As more suppliers join these ecosystems, buyer participation increases, creating a virtuous cycle that explains the exponential growth curve we’re witnessing. Platforms that reached critical mass early are now experiencing what analysts call “escape velocity“—a self-reinforcing growth pattern that makes them increasingly difficult to displace.

Why Traditional Procurement Methods Are Disappearing

Traditional procurement—characterized by manual RFQs, lengthy negotiation cycles, and relationship-dependent purchasing—is rapidly becoming obsolete. By 2026, an estimated 78% of all B2B transactions will involve at least one digital marketplace touchpoint. The inefficiencies of traditional methods have become increasingly untenable in a business environment that demands agility, transparency, and data-driven decision making.

The limitations are stark: traditional procurement typically involves 5-7x longer sourcing cycles, 30% higher administrative costs, and significantly reduced visibility into market pricing. Most critically, it limits businesses to the suppliers they already know, creating massive opportunity costs in terms of innovation and competitive pricing. In contrast, leading B2B marketplaces provide instant access to thousands of pre-vetted suppliers, algorithmic matching to optimal partners, and real-time pricing intelligence.

Top 5 General B2B Marketplaces Dominating in 2026

While specialized platforms continue to emerge, several general-purpose B2B marketplaces have established dominant positions that are projected to strengthen through 2026. These platforms offer the broadest range of products and services, the most robust ecosystem of participants, and increasingly sophisticated tools for discovery, negotiation, and transaction management.

1. Alibaba.com: The Continued Global Leader

Despite mounting competition, Alibaba.com is projected to maintain its position as the world’s largest B2B marketplace through 2026. Its unmatched scale—connecting over 200 million businesses globally—continues to create powerful network effects that new entrants struggle to replicate. What’s changing is Alibaba’s strategic focus, with significant investments in AI-powered supplier verification, logistics integration, and embedded financial services transforming it from a simple matching platform to a comprehensive business services ecosystem.

- New Trade Assurance program guarantees product quality and on-time shipping with up to $1M in protection

- AI-driven matchmaking engine with 94% accuracy in connecting buyers with optimal suppliers

- Enhanced verification system using blockchain to authenticate supplier credentials and manufacturing capabilities

- Multi-currency settlement options with embedded financing offering terms up to 90 days

- Virtual factory tours allowing remote inspection of production facilities before commitment

Alibaba’s 2025 introduction of industry-specific sub-marketplaces has proven particularly effective, with specialized procurement workflows for sectors like electronics, textiles, and industrial equipment. This segmentation strategy has helped counter the rise of vertical-specific competitors while maintaining the advantages of scale. For Western businesses seeking Asian suppliers in particular, Alibaba remains the essential starting point despite emerging alternatives.

2. Amazon Business: Beyond Consumer Retail

Amazon Business has evolved dramatically from its initial position as a simple extension of Amazon’s consumer marketplace. By 2026, it’s projected to handle over $80 billion in B2B transactions annually, making it the second-largest general B2B marketplace globally. Its primary advantage remains the seamless integration with existing Amazon infrastructure—from logistics to payment processing—creating efficiencies that specialized competitors struggle to match.

What’s driving Amazon Business’s continued growth is its aggressive push into enterprise procurement. The platform’s Business Prime program now includes sophisticated approval workflows, spending analytics, and integration with major ERP systems. These features have made it increasingly attractive to mid-market and enterprise customers who previously viewed Amazon as primarily a spot-buy solution rather than a strategic procurement partner.

The introduction of Amazon Business’s “Verified Supplier” program in 2024 has been particularly impactful, addressing previous concerns about counterfeit products and supplier reliability. This rigorous verification process, combined with AI-powered anomaly detection in supplier behavior patterns, has significantly elevated trust levels among procurement professionals who previously hesitated to use the platform for critical purchases.

3. Thomasnet: Manufacturing’s Digital Transformation

Once primarily known as a supplier directory, Thomasnet has transformed into a comprehensive manufacturing marketplace. Its strategic focus on North American manufacturing has positioned it perfectly to capitalize on reshoring trends and supply chain regionalization. By specializing in industrial components, custom manufacturing services, and MRO supplies, Thomasnet has carved out a dominant position in a high-value segment that general marketplaces struggle to serve effectively.

Thomasnet’s 2025 introduction of its “Digital Twin Marketplace” represents a genuine innovation in the space. This feature allows buyers to upload CAD designs and receive instant manufacturability feedback, pricing estimates, and supplier matches across its network of over 500,000 North American manufacturers. For complex custom components, this dramatically accelerates the RFQ process from weeks to hours.

For those interested in the broader technological landscape, exploring future innovations and trends in connectivity can provide valuable insights.

4. eWorldTrade: The Emerging Powerhouse

While less familiar to Western businesses than Alibaba or Amazon Business, eWorldTrade has emerged as a formidable global player. Its rapid growth has been driven by superior international payment security features and exceptionally strong penetration in emerging markets that are underserved by established platforms. The marketplace now connects over 15 million businesses across 190 countries, with particularly strong representation from South Asia, Southeast Asia, and Africa.

What distinguishes eWorldTrade is its emphasis on small and medium manufacturer discovery. Unlike platforms that primarily feature large-scale producers, eWorldTrade has developed specialized tools to validate smaller manufacturers, including virtual factory inspections and incremental trust-building mechanisms. This has opened access to production capabilities that were previously invisible to global buyers, creating new sourcing options particularly valued in specialized manufacturing categories.

5. Faire: Revolutionizing Wholesale

Having expanded well beyond its initial focus on boutique retail merchandise, Faire has emerged as a transformative force in small-to-medium business wholesale. Its AI-powered product recommendation engine has proven remarkably effective at matching merchants with products that perform well in their specific market contexts. This data-driven approach to wholesale—combined with favorable payment terms and return policies—has attracted over 500,000 retailers and 70,000 brands to the platform.

Faire’s expansion into industrial categories beginning in 2024 has significantly broadened its relevance beyond consumer goods. The platform now facilitates B2B transactions across 25 major product categories including light industrial equipment, restaurant supplies, and commercial construction materials. This diversification strategy, coupled with its user-friendly interface designed specifically for SMB procurement, has fueled compound annual growth of 43% since 2023.

Industry-Specific B2B Marketplace Leaders

While general marketplaces offer breadth, industry-specific platforms deliver specialized functionality tailored to vertical-specific requirements. These specialized marketplaces are growing at a 27% faster rate than general platforms, demonstrating the value of deep domain expertise in complex procurement categories. By 2026, industry analysts project that 65% of strategic B2B purchases will flow through these specialized platforms rather than general marketplaces, highlighting the importance of SEO automation tools in maintaining competitive advantage.

Healthcare: Medline and MedTech Platforms

Healthcare procurement has undergone remarkable transformation, with specialized platforms like Medline’s Digital Exchange and H-Source leading adoption. These platforms have moved well beyond simple medical supply transactions to include equipment leasing, service procurement, and even specialized staffing solutions. Regulatory compliance features are the key differentiator, with built-in verification of credentials, lot traceability, and documentation management that general marketplaces cannot effectively replicate.

The integration of clinical outcomes data with procurement decisions represents the cutting edge in this sector. Platforms like Curvo and OpenMarkets now incorporate real-world performance metrics into product listings, allowing healthcare providers to evaluate supplies and equipment based on patient outcomes rather than just price. This value-based procurement approach is projected to dominate healthcare purchasing by 2026, with an estimated 78% of hospitals prioritizing outcomes data over traditional metrics.

Construction: EquipmentShare and BuilderExchange

Construction-focused marketplaces have evolved far beyond equipment rental to become comprehensive project resource platforms. EquipmentShare’s transformation into a full-service construction marketplace now encompasses material procurement, subcontractor sourcing, and equipment financing. Its integration with BIM (Building Information Modeling) systems allows for automated material quantity takeoffs and direct procurement from digital models—a capability that has reduced material waste by an average of 23% on projects using the platform.

BuilderExchange has established itself as the leading specialty platform for sustainable construction materials. Its verification protocols for environmental product declarations (EPDs) and health product declarations (HPDs) have made it indispensable for projects seeking green building certifications. The platform’s carbon impact calculator, which provides real-time comparisons of material choices based on embodied carbon, exemplifies the specialized functionality that general marketplaces cannot easily replicate.

For those interested in the future of technology in construction, exploring 5G and AI connectivity trends can provide further insights.

Food Service: FoodMaven and BlueCart Innovations

The food service industry has embraced specialized B2B marketplaces that address the unique challenges of perishable inventory management, regulatory compliance, and just-in-time delivery requirements. FoodMaven’s platform, which originally focused on reducing food waste by connecting suppliers with excess inventory to buyers, has expanded to become a comprehensive food service procurement solution with over 25,000 restaurants and institutional kitchens now sourcing through the platform.

BlueCart’s integration of inventory management, ordering, and invoicing has created particular value for multi-location restaurant operations. Its real-time price comparison feature, which automatically identifies price variations across distributors, has proven especially valuable during periods of food price volatility. The platform’s supplier verification system, which includes third-party food safety certification validation, addresses critical compliance concerns that general marketplaces typically overlook.

Electronics: Global Sources and Component Exchanges

The electronics component shortage of 2021-2023 dramatically accelerated adoption of specialized marketplaces in this sector. Platforms like Global Sources and Sourceability’s Datalynq have evolved to provide much more than simple component matching. Their value now centers on supply chain risk management, with real-time visibility into component availability, lead times, and potential counterfeit risks across thousands of suppliers globally.

The integration of 5G and AI connectivity further enhances these platforms, offering innovative solutions for future trends in electronics.

These specialized platforms now incorporate lifecycle management features that alert procurement teams to upcoming component obsolescence, suggest compatible alternatives, and provide access to authorized aftermarket sources. This functionality has become essential as product lifecycles continue to shrink while manufacturers must support products in the field for increasingly extended periods.

Regional B2B Marketplace Champions

While global platforms dominate headlines, regional B2B marketplaces have gained significant traction by addressing specific geographic needs, regulatory environments, and business cultures. These platforms often offer superior logistics integration, payment solutions optimized for local financial systems, and more effective supplier verification in their regions of focus.

Asia-Pacific Platforms: Beyond Alibaba

While Alibaba remains dominant, specialized regional platforms are capturing specific market segments across Asia-Pacific. India’s Udaan has established itself as the leading platform for FMCG distribution, connecting over 3 million retailers with manufacturers and achieving $4.5 billion in annualized GMV. Its success stems from addressing India-specific challenges including complex distribution networks, regional taxation variations, and the credit requirements of small retailers.

In Southeast Asia, Proxtera has emerged as a government-backed “meta-marketplace” connecting SMEs across ASEAN nations. Its unique approach—federating existing B2B platforms rather than competing with them—has created unprecedented cross-border trading opportunities for smaller businesses. The platform’s integration with regional payment systems and customs documentation has removed significant friction from intra-ASEAN trade, driving 67% year-over-year growth since its 2023 expansion.

European Digital Trade Networks

Europe’s fragmented regulatory environment has historically complicated cross-border B2B commerce, but specialized platforms are now solving these challenges. Mercateo has emerged as the dominant pan-European marketplace, with its “Unite” platform now connecting over 1.5 million businesses across 15 countries. Its key innovation is its compliance engine, which automatically manages country-specific tax requirements, product regulations, and documentation needs for cross-border transactions.

In specialized sectors, European platforms have developed unique strengths. Wucato (operated by Würth Group) has established dominance in industrial supplies, while France’s Ankorstore has revolutionized independent retail sourcing across the continent. These platforms have succeeded by deeply understanding European business practices, particularly around payment terms, invoicing requirements, and sustainability documentation that international players often overlook.

North American B2B Ecosystems

Beyond Amazon Business, North America has seen significant development of specialized B2B marketplaces with regional focus. Faire and Thomasnet have already been discussed as category leaders, but platforms like Knowde (chemicals), Material Bank (architecture and design materials), and Tekmetric Connect (automotive parts) demonstrate the trend toward high-functioning vertical solutions with strong regional optimization.

For those interested in enhancing their SEO strategies, exploring the best web scraping tools for SEO can provide valuable insights into market trends and competitor analysis.

What distinguishes North American platforms is their advanced integration capabilities. These marketplaces typically offer more sophisticated connections to enterprise systems like SAP, Oracle, and Workday than their international counterparts. This integration focus reflects the higher technology adoption rates among North American businesses and creates significant competitive advantages for platforms that effectively reduce procurement friction.

Emerging Markets: Africa and Latin America

The most dramatic B2B marketplace growth is occurring in emerging markets, where these platforms are often leapfrogging traditional distribution infrastructure entirely. Africa’s Sokowatch has transformed informal retail supply chains across six countries, enabling small shops to order inventory via mobile app with same-day delivery. Its success demonstrates how B2B marketplaces can solve fundamental infrastructure challenges rather than simply digitizing existing processes.

In Latin America, Cargamos and Moova have reimagined B2B logistics, creating marketplaces that connect businesses with available transportation capacity. These platforms have reduced shipping costs by 32% on average while improving delivery reliability in regions with challenging logistics landscapes. Their rapid adoption illustrates how B2B marketplaces are addressing region-specific pain points that global platforms often neglect.

AI-Powered Features Transforming B2B Marketplaces

Artificial intelligence has moved beyond buzzword status to become the defining competitive advantage for leading B2B marketplaces in 2026. These platforms are deploying increasingly sophisticated AI capabilities that fundamentally transform how businesses discover, evaluate, and transact with potential partners. The most impactful applications focus on reducing friction, enhancing trust, and creating personalized experiences that were impossible in traditional procurement.

Smart Matchmaking Between Buyers and Suppliers

The days of simple keyword-based supplier searches are disappearing. Leading marketplaces now employ sophisticated matching algorithms that consider dozens of variables beyond basic product specifications. These systems analyze historical purchasing patterns, quality ratings, delivery performance, geographical optimization, and even communication responsiveness to identify ideal matches. The result is a dramatic reduction in sourcing time—from days or weeks to minutes or seconds—while simultaneously improving match quality.

Advanced platforms like Thomasnet now incorporate natural language processing that can interpret even complex technical requirements from conversational queries. A procurement professional can describe a needed component in everyday language, and the system will translate this into precise technical specifications before identifying matching suppliers. This capability is particularly valuable for non-technical procurement staff who may lack the specialized vocabulary to efficiently search traditional catalogs.

Predictive Analytics for Inventory Management

B2B marketplaces are increasingly embedding predictive inventory intelligence that extends well beyond simple product availability. These systems analyze historical purchasing patterns, seasonal trends, market signals, and even weather forecasts to anticipate potential supply disruptions before they occur. For buyers, this translates into proactive notifications about potential stock issues and suggested alternative sourcing strategies.

The most advanced platforms now offer “demand forecasting as a service,” using aggregated marketplace data to help both buyers and suppliers optimize inventory levels. This shared intelligence helps reduce the bullwhip effect that has traditionally plagued supply chains, creating more efficient inventory management across entire industries rather than just individual businesses.

Automated Negotiation Tools

AI-powered negotiation assistants are fundamentally changing how businesses establish commercial terms. These systems can automatically handle routine price negotiations based on volume, timing, and relationship factors, freeing human representatives to focus on more strategic aspects of partnerships. Early implementations have demonstrated 15-20% time savings in procurement processes while often achieving more favorable terms than manual negotiations.

What makes these systems particularly effective is their ability to learn from thousands of similar transactions across the marketplace. By analyzing patterns in successful negotiations, they can suggest optimal starting positions, identify potential concessions, and recognize when human intervention would be valuable. This data-driven approach to negotiation represents a significant advantage over traditional methods based primarily on individual experience and intuition.

Real-Time Translation Breaking Language Barriers

Language barriers have historically limited cross-border B2B commerce, but AI-powered translation is effectively eliminating this constraint. Leading marketplaces now offer real-time translation of product specifications, negotiation communications, and contractual terms across dozens of languages. The accuracy of these translations has improved dramatically, with technical vocabulary recognition reaching over 97% accuracy in major language pairs.

For more insights into how AI is transforming industries, explore the future innovations and trends in AI and connectivity.

Beyond simple text translation, these systems now support voice translation for video conferences and even document translation that maintains formatting and technical specifications. This capability has proven particularly valuable for connecting SMEs in emerging markets with global opportunities that were previously inaccessible due to language constraints.

How to Choose the Right B2B Marketplace for Your Business

With hundreds of B2B marketplaces now available, selecting the optimal platforms for your business requires careful strategic consideration. The right choice depends on your specific industry, geographic focus, transaction volume, and integration requirements. Most importantly, it requires alignment with your broader digital transformation and supply chain resilience strategies.

The most successful businesses are adopting a portfolio approach rather than relying on a single marketplace. Research indicates that companies using 3-5 complementary B2B platforms achieve 28% greater supplier diversity and 23% better pricing than those using fewer options. However, this multi-platform strategy requires thoughtful orchestration to avoid fragmenting purchasing data and creating inefficiencies.

Industry Alignment and Specialization

Industry-specific capabilities should typically be your primary selection criterion. Vertical-focused marketplaces offer functionality tailored to your industry’s unique requirements, whether that’s regulatory compliance in healthcare, BIM integration in construction, or component lifecycle management in electronics. These specialized features often deliver more value than the broader reach of general marketplaces, particularly for strategic categories rather than indirect spending.

Evaluate platforms based on their understanding of your industry’s specific workflows, documentation requirements, and quality standards. The best indication of this specialization is the presence of industry-specific search filters, certification verifications, and technical specifications that go beyond basic product information. Leading platforms will also offer industry benchmarking that helps you understand how your procurement performance compares to peers.

Commission Structure and Pricing Models

B2B marketplace business models have evolved significantly, with important implications for total cost of procurement. Beyond simple transaction fees, evaluate subscription costs, payment processing fees, and potential premium placement charges that might impact your suppliers. The most transparent platforms provide clear total cost calculations and offer volume-based pricing tiers that reward consistent usage.

Be particularly attentive to fee structures that might influence supplier behavior. Some marketplaces charge suppliers high commissions that inevitably get passed back through pricing, while others generate revenue primarily from value-added services like financing, logistics, or analytics. Platforms that align incentives across all participants typically deliver better long-term value than those optimizing for marketplace revenue at the expense of participants.

Supplier Verification and Trust Mechanisms

Supplier quality remains the most critical concern for businesses adopting B2B marketplaces. Evaluate platforms based on their verification processes, ongoing monitoring systems, and dispute resolution mechanisms. The most trustworthy marketplaces employ multi-layered verification including business registration checks, physical location verification, production capability assessment, and customer reference validation.

Look for platforms that provide transparent performance metrics rather than simple star ratings. The most valuable indicators include on-time delivery percentage, quality consistency measures, communication responsiveness, and issue resolution statistics. These objective metrics provide much stronger signals than subjective ratings that may be manipulated or reflect non-representative experiences.

Integration Capabilities with Your Existing Systems

Even the best marketplace delivers limited value if it creates a procurement silo disconnected from your core business systems. Evaluate platforms based on their integration capabilities with your ERP, inventory management, and accounting systems. The most advanced marketplaces offer pre-built connectors for major enterprise systems, API access for custom integration, and middleware partnerships that simplify connection to legacy systems.

Beyond technical integration, consider workflow alignment with your existing processes. Leading platforms offer configurable approval workflows, budget control mechanisms, and role-based permissions that can mirror your internal governance requirements. This alignment significantly reduces change management challenges and improves adoption rates among procurement teams.

Global Reach vs. Regional Focus

While global marketplaces offer the broadest supplier networks, regional platforms often provide superior experiences for specific geographies. Consider your expansion strategy and supply chain resilience requirements when evaluating geographic coverage. Many businesses are adopting a hybrid approach, using global platforms for price discovery and category exploration while relying on regional marketplaces for execution and relationship management.

For international sourcing, evaluate marketplaces based on their cross-border capabilities including landed cost calculation, customs documentation support, international payment options, and localized support. The strongest platforms offer “global discovery with local execution,” combining worldwide supplier access with regionally optimized transaction processes.

Sustainability Features Becoming Standard in 2026

Environmental and social governance (ESG) considerations have moved from optional to essential in B2B procurement. Leading marketplaces have responded by developing sophisticated sustainability features that help businesses meet increasingly stringent regulatory requirements and stakeholder expectations. By 2026, these capabilities will be standard requirements rather than competitive differentiators.

For those interested in how technology can impact these developments, exploring future innovations and trends in connectivity can provide valuable insights.

Carbon Footprint Tracking

Carbon accounting across supply chains has become mandatory in many jurisdictions, driving marketplace innovation in emissions tracking. Advanced platforms now offer product-level carbon footprint data covering both production and logistics emissions. This granular information enables businesses to make sustainability-informed sourcing decisions and accurately report scope 3 emissions to regulators and stakeholders.

The most sophisticated marketplaces have integrated carbon impact into their core search and filtering functionality, allowing businesses to automatically prioritize lower-emission alternatives. Some platforms have even introduced carbon budgeting features that help procurement teams balance sustainability objectives with other business requirements across their entire purchasing portfolio.

Ethical Sourcing Verification

Labor practices, human rights, and ethical sourcing have become critical considerations in supplier selection. Leading B2B marketplaces now offer comprehensive verification of social compliance, including third-party audits of working conditions, fair labor certifications, and ongoing monitoring systems. These capabilities help businesses mitigate reputation risks while meeting increasingly stringent supply chain transparency regulations.

Beyond basic compliance, advanced platforms now provide detailed social impact metrics that quantify a supplier’s community contributions, diversity initiatives, and worker development programs. This information enables values-aligned procurement that considers a supplier’s complete social footprint rather than simply avoiding negative practices.

Circular Economy Initiatives

As regulatory pressure around product lifecycle management intensifies, B2B marketplaces are developing circular economy features that support extended producer responsibility. These capabilities include end-of-life management services, remanufacturing coordination, and materials recovery marketplaces that connect waste streams from one business with input requirements of another.

Particularly innovative platforms have introduced “product-as-a-service” marketplaces that facilitate access-based business models rather than traditional ownership. These arrangements—whether for industrial equipment, IT assets, or transportation—align economic incentives with product longevity and material efficiency, creating both environmental and financial benefits.

For those interested in exploring beginner e-commerce platforms, understanding these innovative business models can be particularly beneficial.

Security Innovations Protecting B2B Transactions

Security concerns remain the primary hesitation for businesses considering B2B marketplaces. In response, leading platforms have implemented multi-layered security innovations that often exceed the protections of traditional procurement channels. These advancements are particularly important as transaction values increase and more strategic purchases move to marketplace platforms.

Blockchain-Based Verification

Blockchain technology has moved beyond cryptocurrency to become a foundational trust layer in advanced B2B marketplaces. These systems create immutable records of supplier credentials, product certifications, and transaction histories that cannot be retroactively altered. For buyers, this provides unprecedented verification capabilities, particularly for critical attributes like regulatory compliance, authenticity, and chain of custody.

The most sophisticated implementations use blockchain to create digital “product passports” that document a product’s complete history from raw material to delivery. This capability is particularly valuable in industries like pharmaceuticals, aerospace, and luxury goods where counterfeit products present significant risks. The transparency extends to logistics, with real-time location tracking and condition monitoring creating auditable records of a product’s journey.

Advanced Fraud Prevention Systems

Machine learning has dramatically improved fraud detection in B2B marketplaces, with algorithms that identify suspicious patterns across millions of transactions. These systems can detect anomalies that would be invisible to human reviewers, from subtle changes in communication patterns to unusual shipping routes that might indicate diverted products. As a result, leading marketplaces now report fraud rates below 0.1% of transaction value—significantly better than traditional procurement channels.

Secure Payment Gateways

Payment security has advanced well beyond basic encryption to include sophisticated escrow services, conditional release mechanisms, and integrated trade financing. These systems protect both buyers and sellers by ensuring that funds are only transferred when predefined conditions are met. For international transactions, these capabilities dramatically reduce risk compared to traditional methods like wire transfers or letters of credit.

The integration of financial services into marketplace platforms has created particularly compelling security advantages. By embedding trade credit, supply chain financing, and payment protection within the transaction flow, these platforms can leverage their visibility into both sides of the transaction to offer security that traditional financial institutions cannot match.

Making the Most of B2B Marketplaces: Strategic Tips

Successful marketplace utilization requires more than simply creating an account and listing products. The businesses achieving the greatest value are approaching these platforms strategically, investing in capabilities that enhance their digital presence and applying data-driven methodologies to continuous improvement. These best practices apply across industries and platform types, though the specific implementation details may vary.

The most important mindset shift is viewing marketplaces as strategic channels rather than simply transactional platforms. Leading organizations have established dedicated marketplace management teams with cross-functional representation from sales, marketing, supply chain, and IT. This integrated approach ensures alignment between marketplace activities and broader business objectives.

For those looking to enhance their marketplace strategies, exploring web scraping tools can provide valuable insights and data to inform decision-making.

Building Your Digital Brand Presence

In the crowded B2B marketplace environment, your digital storefront has become as important as your physical facilities. Invest in comprehensive profiles that go beyond basic company information to showcase your capabilities, certifications, and unique value propositions. Leading performers create industry-specific content that demonstrates expertise and addresses common customer pain points rather than simply listing products.

For those looking to enhance their online presence, consider exploring the best web scraping tools for SEO to gather valuable insights and optimize your content strategy.

Visual assets have become increasingly important differentiators. Businesses achieving the highest conversion rates consistently provide high-quality product photography, application videos, and virtual facility tours. These investments significantly impact buyer confidence, particularly for complex products or when physical inspection isn’t possible. The return on investment for professional visual content is typically 5-7x in terms of increased transaction value.

For businesses exploring e-commerce solutions, reviewing beginner e-commerce platforms can be a crucial step in enhancing their online presence.

Optimizing Product Listings for Maximum Visibility

Marketplace algorithms have become increasingly sophisticated in determining which products appear in search results and recommendations. Understanding these algorithms—and optimizing your listings accordingly—can dramatically impact visibility. Focus on comprehensive specification data, detailed application information, and structured attribute fields rather than simply marketing descriptions.

Leveraging Analytics to Improve Performance

The data generated by B2B marketplaces provides unprecedented visibility into buyer behavior, competitive positioning, and market trends. Leading organizations establish systematic processes for analyzing this data and translating insights into action. Start with basic performance metrics like page views, conversion rates, and average order values, then progress to more sophisticated analyses of search term patterns, abandoned cart behaviors, and competitive pricing dynamics.

The most valuable insights often come from comparing performance across different marketplaces. This comparative analysis can reveal platform-specific optimization opportunities and help you allocate resources to the channels delivering the highest returns. It can also identify product categories or customer segments where your digital presence may be underperforming relative to your capabilities.

For a detailed review, check out this comparison of e-commerce platforms.

Managing Multi-Marketplace Strategies

As the B2B marketplace landscape continues to fragment, coherent multi-platform strategies have become essential. Rather than applying a one-size-fits-all approach, leading organizations develop platform-specific strategies that leverage the unique strengths of each marketplace. This might mean using general platforms for broad visibility while concentrating specialized products on vertical-specific marketplaces with more qualified buyers.

The Future of B2B Commerce: Beyond 2026

While 2026 will represent a milestone in B2B marketplace adoption, the transformation will continue well beyond this horizon. Several emerging technologies and business model innovations are already visible in early-stage implementations, pointing toward the next evolution of digital B2B commerce. Organizations that anticipate these trends will be best positioned to maintain competitive advantage as the landscape continues to evolve.

The broader pattern is clear: B2B commerce is moving toward increasingly integrated, automated, and intelligent systems that blur the lines between internal operations and external marketplaces. The distinctions between ERP, procurement, and marketplace platforms are gradually disappearing in favor of seamless business ecosystems that optimize for outcomes rather than transactions.

- Autonomous procurement systems that automatically identify needs and execute purchases based on predefined parameters

- Immersive commerce experiences leveraging augmented and virtual reality for complex product evaluation

- Predictive intelligence shifting procurement from reactive to proactive modes

- Hyperconnected supply networks replacing linear supply chains

- Dynamic pricing models that continuously optimize based on real-time market conditions

The marketplace platforms that succeed in this environment will be those that position themselves as business intelligence partners rather than simply transaction facilitators. The value will increasingly derive from the insights, predictions, and connections these platforms enable rather than just the transactions they process.

The Metaverse and Virtual Showrooms

The early implementations of metaverse technologies in B2B contexts have focused primarily on virtual product demonstrations and remote facility tours. By 2026, these capabilities will evolve into fully immersive commerce environments where buyers can interact with products, customize configurations, and collaborate with suppliers in shared virtual spaces. Early adopters report 40-60% shorter sales cycles for complex products when utilizing these immersive technologies.

The most compelling applications combine digital twins of physical products with collaborative spaces where multiple stakeholders can simultaneously evaluate options. This capability is particularly valuable for engineered products where design decisions impact multiple functional areas, allowing procurement teams, engineers, operations staff, and suppliers to collaborate in real-time regardless of physical location.

Quantum Computing’s Impact on Supply Chain

Quantum Advantage in Supply Chain Optimization

Problem Type: Multi-variable optimization with constraints

Classical Computing: Hours to days for complex scenarios

Quantum Computing: Seconds to minutes

Decision Variables: Can handle 1000+ variables simultaneously

Applications: Network design, inventory optimization, multi-echelon planning

Source: Quantum Economic Development Consortium, 2025

Quantum computing’s commercial applications will first emerge in complex optimization problems—precisely the challenges that dominate supply chain and procurement. By 2028, quantum-powered marketplaces will optimize not just individual transactions but entire supply networks, considering thousands of variables simultaneously to identify optimal sourcing strategies that would be computationally infeasible with classical methods.

The immediate applications include route optimization, inventory positioning, and supplier selection across complex multi-tier supply chains. These capabilities will transform procurement from a transaction-focused function to a strategic optimization discipline that balances cost, risk, sustainability, and performance across the entire value chain.

The marketplaces that gain early access to quantum capabilities will have significant advantages in matching efficiency, pricing optimization, and predictive analytics. This technology gap may temporarily reverse the fragmentation trend as scale becomes necessary to justify quantum investments, potentially driving consolidation among marketplace providers.

The End of Traditional Distribution Models

Perhaps the most profound long-term impact of B2B marketplaces will be the fundamental restructuring of distribution models across industries. The traditional multi-tier distribution system—with manufacturers selling to distributors who sell to retailers or end customers—is gradually being replaced by more direct, digitally-enabled connections. This transformation promises greater efficiency but creates significant disruption for businesses built around traditional distribution functions.

- Traditional distributors are evolving into technology-enabled service providers rather than inventory holders

- Manufacturers are developing direct digital channels while maintaining distributor relationships

- Value-added services are replacing product margins as the primary profit center

- Data and insights are becoming more valuable than physical distribution capabilities

- Hybrid models combining marketplace reach with local service are emerging as the dominant approach

The most successful companies in this environment will be those that identify their true value creation mechanisms and evolve accordingly. For distributors, this typically means doubling down on specialized expertise, logistics capabilities, or value-added services rather than competing with marketplaces on basic product fulfillment. For manufacturers, it means developing more sophisticated channel management capabilities that can balance direct digital relationships with traditional partner networks. For more insights on how these dynamics are shaping the industry, explore the best online B2B marketplaces of the future.

The transition creates both threats and opportunities. Organizations that cling to traditional distribution models will face increasing margin pressure and gradual disintermediation. Those that embrace the digital transformation can often expand their reach, enhance their value propositions, and develop more direct customer relationships than were possible in traditional channels.

Frequently Asked Questions

As B2B marketplaces continue to evolve rapidly, procurement teams and suppliers alike have important questions about how to navigate this changing landscape. These frequently asked questions address the most common concerns and provide practical guidance based on current market conditions and projected developments through 2026.

The answers reflect both aggregate marketplace data and specific experiences from early adopters across multiple industries. While individual circumstances may vary, these responses provide a starting point for developing your organization’s marketplace strategy.

How much does it cost to join a B2B marketplace in 2026?

Pricing models vary significantly across platforms, but several patterns have emerged. General marketplaces typically offer free basic listings with premium tiers offering enhanced visibility, detailed analytics, and integration capabilities. These premium tiers range from $200-$2,000 monthly depending on transaction volume and feature requirements. Transaction fees average 3-5% for general marketplaces, though high-value categories may see lower percentages.

Specialized vertical marketplaces often employ different models, with many charging subscription fees rather than transaction percentages. These fees typically range from $5,000-$25,000 annually depending on the industry, with healthcare and financial services commanding the highest premiums. However, these specialized platforms often deliver significantly higher conversion rates and average order values, justifying the investment for suppliers in those categories.

What industries benefit most from B2B marketplaces?

While virtually all industries are seeing marketplace adoption, those with fragmented supplier landscapes, complex specification requirements, and high discovery friction show the greatest benefits. Manufacturing components, specialty chemicals, and construction materials have seen particularly strong ROI from marketplace adoption, with average procurement efficiency improvements of 35-45% and significant cost savings through broader supplier access.

Industries with regulated products or complex compliance requirements also benefit substantially from specialized marketplaces that embed verification processes into the platform. Healthcare, food service, and industrial safety equipment markets have developed sophisticated ecosystems that significantly reduce compliance risk while streamlining procurement processes. The value proposition in these sectors extends well beyond simple price comparisons to include risk reduction and documentation management.

Can small businesses compete effectively on major B2B platforms?

The data shows increasingly favorable conditions for SMEs on major B2B marketplaces. While early marketplace iterations favored large suppliers with extensive digital capabilities, platform enhancements have leveled the playing field considerably. SMEs now report customer acquisition costs 50-70% lower through marketplaces compared to traditional sales channels, with particularly strong performance in specialized product categories where they can demonstrate unique expertise.

How do B2B marketplaces verify supplier authenticity?

Verification protocols have become significantly more robust as marketplace transaction values increase. Leading platforms now employ multi-layered approaches combining document verification, physical location confirmation, manufacturing capability assessment, and third-party certifications. Many have implemented site visits (either in-person or virtual) for suppliers above certain transaction thresholds or in high-risk categories.

What integration tools do I need for B2B marketplace success?

The minimum viable integration typically includes inventory management, order processing, and basic analytics connections. As marketplace volume grows, more sophisticated integrations with ERP systems, CRM platforms, and logistics networks become increasingly valuable. The most advanced users implement real-time synchronization across all business systems, enabling dynamic pricing, automated inventory allocation, and predictive analytics based on marketplace activity.

For suppliers active on multiple marketplaces, integration platforms like Channel Advisor, Productsup, and Feedonomics offer centralized management capabilities that can significantly reduce operational complexity. These middleware solutions typically cost $1,000-$5,000 monthly depending on transaction volume but deliver substantial efficiency improvements for multi-channel sellers.

As B2B marketplaces continue to evolve, staying informed about emerging platforms, features, and best practices remains essential for competitive advantage. Organizations that view these platforms as strategic channels rather than simply transactional tools will be best positioned to capture their full value potential.

Hey there You have done a fantastic job I will certainly digg it and personally recommend to my friends Im confident theyll be benefited from this site

Thank you so much for the kind words! We really appreciate your support and we’re glad you found it helpful.