Key Takeaways

- Crypto arbitrage involves exploiting price differences of the same cryptocurrency across different exchanges to generate profit

- The fragmented nature of cryptocurrency markets creates inefficiencies that traders can capitalize on with relatively low risk

- There are four main types of crypto arbitrage strategies: cross-exchange, triangular, spatial, and DeFi arbitrage

- While potentially profitable, crypto arbitrage requires fast execution, sufficient capital, and careful management of fees and transfer times

- Innovative tools like automated trading bots are making crypto arbitrage more accessible to everyday traders

“What is Crypto Arbitrage Trading? Does …” from metaschool.so and used with no modifications.

In the dynamic world of cryptocurrency trading, savvy investors are constantly searching for strategies that can generate consistent returns while minimizing risk. Crypto arbitrage has emerged as one of the most compelling approaches, allowing traders to capitalize on market inefficiencies without taking on the usual volatility risks associated with crypto markets.

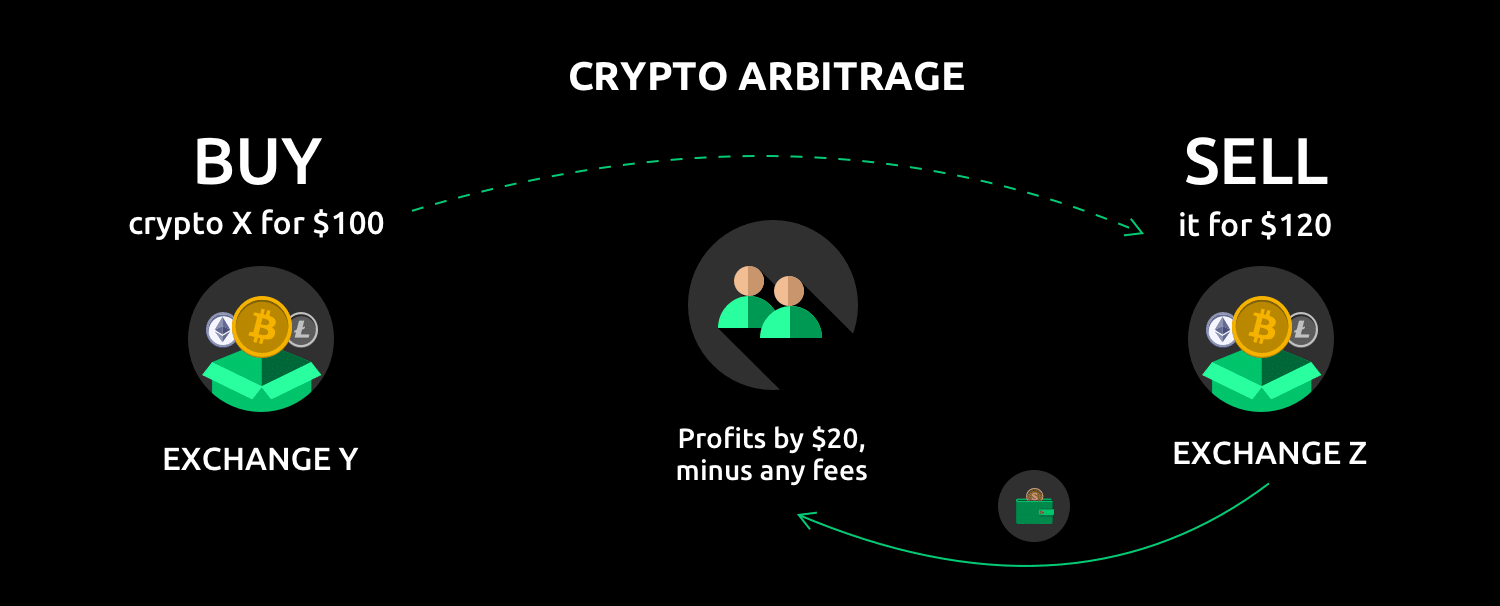

Crypto arbitrage takes advantage of a fundamental market reality: the same cryptocurrency can trade at different prices across different exchanges simultaneously. This price disparity creates opportunities for traders to buy low on one platform and sell high on another, pocketing the difference as profit. As cryptocurrency markets continue to mature, these opportunities persist due to the fragmented nature of the ecosystem.

Crypto Arbitrage: Making Money from Price Differences

The cryptocurrency market operates without a central authority or unified pricing mechanism. This decentralization means that the price of Bitcoin, Ethereum, or any other cryptocurrency can vary—sometimes significantly—from one exchange to another. Unlike traditional financial markets where arbitrage opportunities are quickly erased by institutional traders, the crypto world’s fragmentation and relative youth allow these price gaps to exist long enough for savvy traders to profit.

These price differences don’t exist by accident. They’re the natural result of varying supply and demand dynamics across different trading platforms, geographic regions, and user demographics. When one exchange experiences a surge in buying pressure while another faces more sellers, prices diverge—creating the perfect conditions for arbitrage.

Quick Definition: Buy Low, Sell High Across Exchanges

At its core, crypto arbitrage follows a straightforward principle: identify price discrepancies, buy where the price is lower, and simultaneously sell where the price is higher. The beauty of this approach is that when executed correctly, it can generate profits regardless of whether the overall market is bullish or bearish. This makes arbitrage particularly attractive during periods of market uncertainty when directional trading strategies become riskier.

- Purchase crypto at a lower price on Exchange A

- Transfer those assets to Exchange B where prices are higher

- Sell the assets at the higher price

- Pocket the difference minus fees and transfer costs

- Rinse and repeat as new opportunities arise

While the concept seems simple, successful execution requires precision, speed, and careful attention to detail. Price gaps can close quickly as other arbitrageurs spot the same opportunity, making timing crucial. Additionally, various factors including transaction fees, withdrawal limits, and transfer times can significantly impact profitability. The most successful arbitrage traders develop systems that allow them to identify and act on opportunities faster than the competition.

How Crypto Arbitrage Actually Works

Crypto arbitrage operates on the principle of market inefficiency. In perfectly efficient markets, the same asset would trade at identical prices everywhere, accounting for transaction costs. But cryptocurrency markets are far from perfect. Trading volumes vary dramatically between exchanges, liquidity pools differ in size, and user bases have different priorities and behaviors. All these factors contribute to temporary price discrepancies that arbitrageurs can exploit.

Why Price Differences Happen Between Exchanges

Several factors create and maintain price differences across cryptocurrency exchanges. Liquidity is perhaps the most significant—exchanges with lower trading volumes typically have wider bid-ask spreads and more volatile price movements. Geographic isolation also plays a role, with certain countries having limited access to global markets due to regulations or capital controls. This can create notable price premiums in markets like South Korea (the famous “Kimchi premium”) or regions experiencing economic instability.

Different exchanges also serve different customer bases. Some cater to professional traders with sophisticated tools and lower fees, while others target retail investors with user-friendly interfaces but potentially higher costs. These differences in customer behavior and trading patterns contribute to temporary price misalignments. Additionally, some exchanges list only certain trading pairs or have varying deposit/withdrawal procedures, further fragmenting the market.

Technical limitations also contribute to arbitrage opportunities. Blockchain networks have finite transaction processing capabilities, creating delays in moving assets between platforms. During periods of high network congestion, these delays increase, potentially widening price gaps between exchanges as arbitrageurs struggle to rapidly move funds to capture opportunities.

For more on emerging risks, see the top cybersecurity threats that could impact these systems.

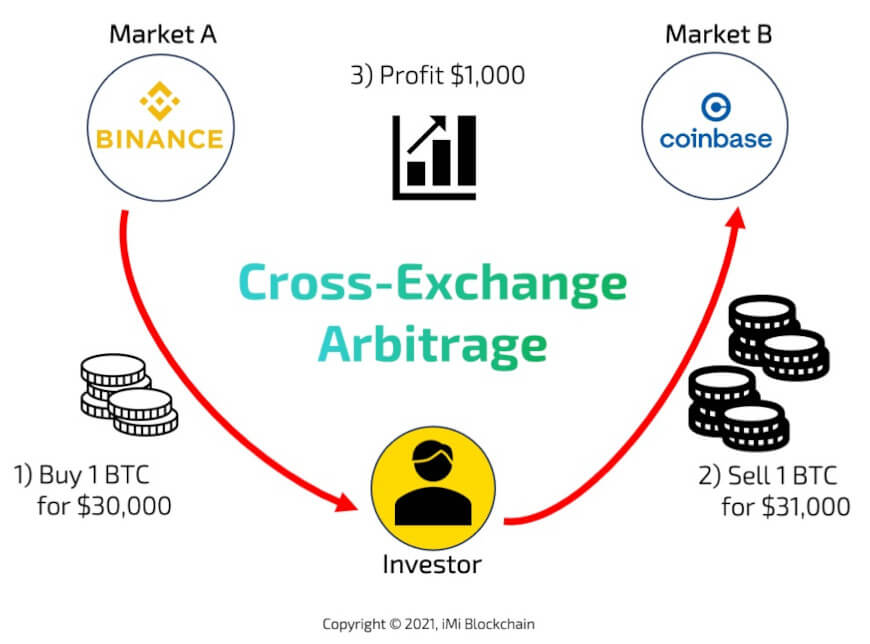

Simple Example: Bitcoin at $30,000 vs $31,000

“Crypto Arbitrage: How to Profit from …” from imiblockchain.com and used with no modifications.

Let’s consider a straightforward example of cross-exchange arbitrage. Imagine Bitcoin is trading at $30,000 on Binance and simultaneously at $31,000 on Coinbase—a $1000 price difference. In theory, a trader could buy 1 BTC on Binance, transfer it to Coinbase, and sell it there for a $1000 profit (minus fees and transfer costs).

Real-world example: In early 2021, during the height of a bull market, Bitcoin frequently traded at a 5-15% premium on certain Korean exchanges compared to U.S.-based platforms, creating significant arbitrage opportunities for traders who could navigate the regulatory hurdles of moving money between these markets.

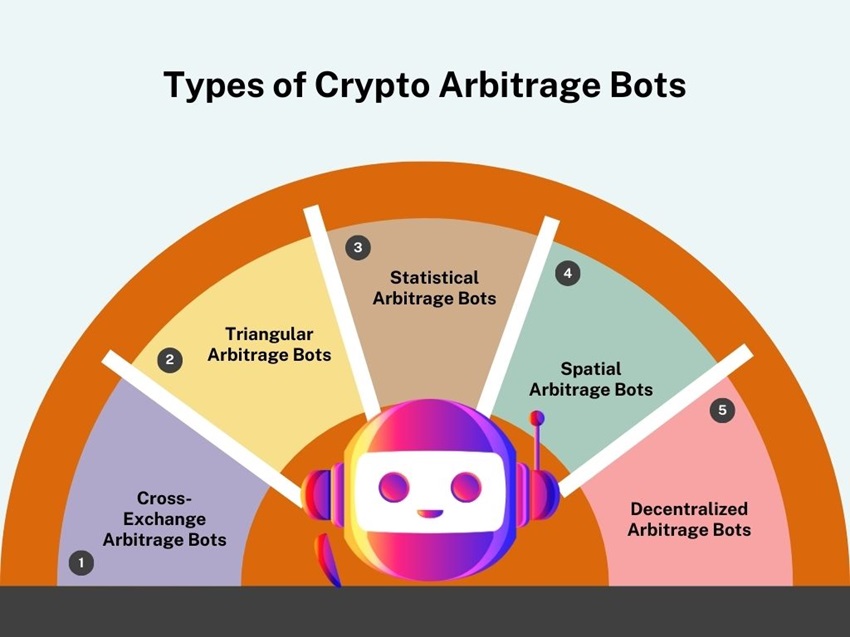

4 Main Types of Crypto Arbitrage Strategies

Crypto arbitrage isn’t a one-size-fits-all approach. As the market has evolved, traders have developed various strategies to capitalize on different types of price inefficiencies. Each approach has its own risk profile, capital requirements, and technical complexity. The most successful arbitrageurs often employ multiple strategies simultaneously to maximize their opportunities across different market conditions.

1. Cross-Exchange Arbitrage

“Crypto Arbitrage Trading Explained …” from bitsgap.com and used with no modifications.

Cross-exchange arbitrage is the most straightforward approach and what most people think of when discussing crypto arbitrage. This strategy involves spotting price differences for the same cryptocurrency across different trading platforms and capitalizing on that gap. For example, if Bitcoin trades at $50,000 on Exchange A but $50,500 on Exchange B, a trader could buy on Exchange A and sell on Exchange B, pocketing the $500 difference (minus fees).

2. Triangular Arbitrage

“Crypto Arbitrage Guide – What It Is and …” from algotrading101.com and used with no modifications.

Triangular arbitrage operates on a single exchange but involves three different cryptocurrencies. This strategy exploits pricing inefficiencies between three trading pairs. For instance, a trader might convert BTC to ETH, then ETH to LTC, and finally LTC back to BTC. If the market isn’t perfectly efficient, this triangular trade could result in owning more BTC than you started with.

This approach has the advantage of eliminating transfer times between exchanges, allowing for faster execution and reducing the risk of price movements during transfers. However, it requires deep understanding of trading pairs and quick mathematical calculations to identify profitable opportunities as they emerge.

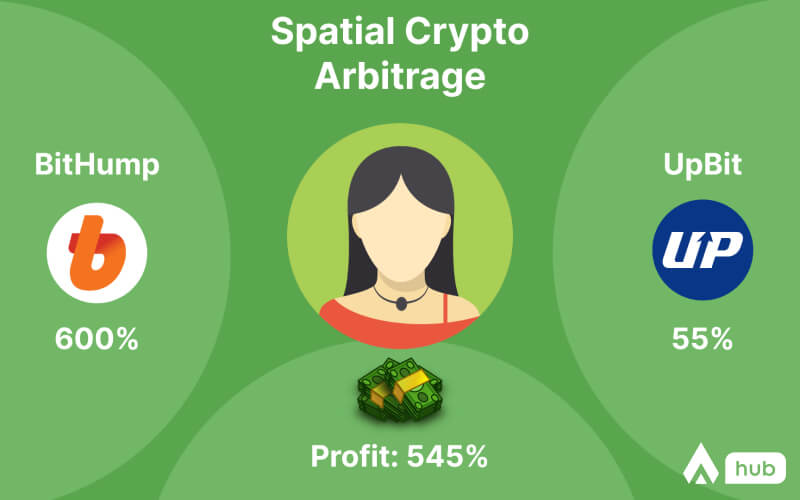

3. Spatial (Geographic) Arbitrage

“Crypto Arbitrage – Altorise …” from altorise.com and used with no modifications.

Spatial arbitrage capitalizes on price differences that arise from geographic and regulatory differences. Certain regions consistently see price premiums due to capital controls, limited exchange options, or high local demand. South Korea’s “Kimchi premium” is a famous example, where Bitcoin has historically traded 5-20% higher than global averages.

Executing spatial arbitrage is complex since it often requires navigating different regulatory environments, banking systems, and sometimes even currency exchanges. Traders need local bank accounts, identity verification in multiple jurisdictions, and an understanding of cross-border financial regulations. While potentially lucrative, these barriers to entry make spatial arbitrage accessible primarily to well-connected or institutional traders.

For those interested in exploring more about trading, you might want to check out the best prop trading firms to understand how opportunities are leveraged.

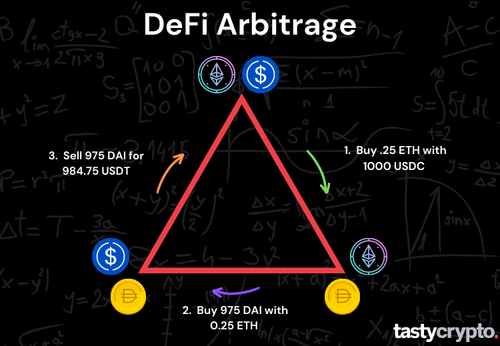

4. Decentralized Finance (DeFi) Arbitrage

“5 DeFi Arbitrage Strategies in Crypto …” from www.tastycrypto.com and used with no modifications.

DeFi arbitrage is the newest frontier, focusing on price discrepancies between decentralized exchanges (DEXs) like Uniswap, SushiSwap, and PancakeSwap. These platforms use automated market makers rather than order books, creating unique arbitrage opportunities when token prices drift from their values on centralized exchanges or other DEXs. For a deeper understanding, check out this guide on crypto arbitrage.

A particularly innovative approach in DeFi arbitrage involves flash loans—uncollateralized loans that must be borrowed and repaid within a single transaction block. This allows traders to execute arbitrage with minimal starting capital, borrowing millions to capitalize on opportunities and repaying the loan from the profits in the same transaction. While powerful, this technique requires smart contract programming skills and carries unique risks like failed transactions and gas fee losses.

Real-World Crypto Arbitrage Examples

Understanding theoretical arbitrage is one thing, but seeing real-world examples helps illustrate how these opportunities manifest in actual markets. These examples demonstrate both the potential and limitations of different arbitrage approaches.

The Kimchi Premium: South Korea’s Price Gap

South Korea’s “Kimchi premium” represents one of the most persistent and significant arbitrage opportunities in crypto markets. During bull markets, Bitcoin and other cryptocurrencies often trade at 5-15% higher prices on Korean exchanges like Upbit and Bithumb compared to international platforms. This premium results from South Korea’s capital controls, which limit the flow of money in and out of the country, combined with high local demand for cryptocurrencies.

In early 2021, the Kimchi premium reached as high as 22%, creating enormous potential profits for traders who could navigate the regulatory hurdles. However, exploiting this opportunity requires having Korean banking relationships, passing strict KYC/AML procedures, and dealing with monthly conversion limits. While institutional players and well-connected individuals have profited from this premium, it remains inaccessible to most global traders.

For those interested in exploring other financial markets, understanding the differences between crypto and forex trading could be beneficial.

Case Study: In April 2021, Bitcoin traded at approximately $66,000 on Korean exchange Bithumb while simultaneously trading at $56,000 on Coinbase—a 17.8% premium. A trader with proper Korean banking access could theoretically purchase 1 BTC on Coinbase, transfer it to Bithumb, sell it, and extract roughly $10,000 in profit (minus fees and taxes).

Flash Loan Arbitrage Opportunities

Flash loans have revolutionized DeFi arbitrage by eliminating the capital barrier to entry. These unique financial instruments allow traders to borrow unlimited funds without collateral, provided they repay the loan within the same transaction block. This creates the ability to execute large-scale arbitrage with minimal starting capital.

In one notable example from 2021, a trader borrowed 5,500 ETH (worth approximately $18 million at the time) through a flash loan on Aave. They used these funds to capitalize on a price discrepancy between Sushiswap and Uniswap for the USDT/ETH pair, executing a complex series of swaps that netted them a profit of 82 ETH (about $270,000) after repaying the loan—all within a single transaction that cost about $200 in gas fees.

If you’re interested in exploring different investment strategies, you might find this comparison of crypto vs. forex trading insightful.

Step-by-Step: How to Start Crypto Arbitrage Trading

Getting started with crypto arbitrage requires careful preparation and a methodical approach. The process involves several crucial steps, from setting up the necessary infrastructure to developing your execution strategy. While arbitrage can be profitable from day one, most successful traders report a learning curve as they optimize their systems and processes.

- Create accounts on multiple exchanges with different fee structures

- Verify your identity on all platforms (this can take days or weeks)

- Set up secure API connections for faster trading execution

- Prepare capital distribution across platforms

- Develop or subscribe to arbitrage opportunity identification tools

Before diving in with significant capital, many experienced arbitrageurs recommend starting with small test transactions to verify that your system works as expected. This allows you to identify any issues with transfers, fees, or execution times before scaling up your operation. Remember that crypto arbitrage is a volume game—the more capital you can deploy efficiently, the more meaningful your returns will be.

Success in crypto arbitrage often comes down to optimization. Shaving seconds off execution time or reducing fees by a few basis points can significantly impact profitability when operating at scale. The most successful arbitrage traders constantly refine their processes based on results and changing market conditions.

1. Set Up Accounts on Multiple Exchanges

The foundation of cross-exchange arbitrage is having trading accounts ready on various platforms. Start by registering on 3-5 major exchanges with different geographical focuses—perhaps Coinbase, Binance, Kraken, FTX, and a regional exchange like Bitso (Latin America) or Upbit (Korea). Complete all verification procedures in advance, as waiting for KYC approval during a prime arbitrage opportunity can be costly.

When selecting exchanges, consider factors beyond just trading volumes. Fee structures, withdrawal limits, processing times, and available trading pairs all affect arbitrage potential. Some exchanges offer fee discounts for high-volume traders or holders of their native tokens, which can significantly impact profitability margins. Security should also be a priority—use platforms with strong track records, insurance policies, and robust security measures.

2. Prepare Your Capital Across Platforms

Effective capital distribution is crucial for successful arbitrage. Since opportunities can arise at any moment, you need funds ready on each exchange to execute trades instantly without waiting for deposits. This typically means dividing your trading capital across multiple platforms, considering the trading volumes and opportunities specific to each exchange.

A common approach is to hold both stablecoins (like USDT or USDC) and major cryptocurrencies (Bitcoin, Ethereum) on each platform. This provides flexibility to capitalize on different types of arbitrage opportunities without conversion delays. Some traders maintain a roughly equal distribution, while others weight their capital toward exchanges with historically larger price discrepancies or better liquidity.

Remember that capital sitting idle isn’t generating returns, so many arbitrageurs deploy unused funds into low-risk yield opportunities when not actively trading. This might include staking stablecoins on the same exchanges or using lending platforms that offer quick withdrawals when needed for arbitrage opportunities.

3. Find Arbitrage Opportunities

Identifying profitable arbitrage opportunities requires continuous market monitoring across multiple exchanges. While manual comparison is possible for beginners, serious arbitrageurs use specialized tools that scan markets in real-time to spot price discrepancies. These range from simple price comparison websites to sophisticated software with automated trading capabilities.

When evaluating potential opportunities, calculate the complete cost including trading fees on both exchanges, network transaction fees, and estimated slippage. Only proceed with trades where the price difference exceeds these combined costs by a comfortable margin. Profitable opportunities typically range from 0.5% to 3% in established markets, though larger gaps can appear during volatile periods or on smaller exchanges.

The most lucrative opportunities often exist with newer altcoins or during major market events when price discovery is less efficient. However, these also carry higher risks in terms of volatility and potential exchange issues. As you gain experience, you’ll develop an intuition for which opportunities offer the best risk-reward profile for your particular setup and risk tolerance.

4. Execute Trades Quickly

Speed is paramount in arbitrage trading. Price gaps can close within seconds or minutes as other traders spot and exploit the same opportunities. Successful arbitrageurs develop systems for near-instantaneous execution, often using exchange APIs to automate parts of the process rather than manually placing orders through website interfaces.

When executing cross-exchange arbitrage, consider the sequence of your trades carefully. Most professionals recommend securing the “sell” side first when possible, as this locks in your profit before making the purchase. However, this approach requires having the asset already available on the selling exchange. If purchasing first, you face the risk of prices moving adversely before you can complete the sell order on the second platform.

For those interested in diversifying their investment strategies, you might want to explore the differences between crypto and forex trading.

For assets with longer transfer times between exchanges, some traders use hedging strategies to protect against price movements during the transfer period. This might involve opening short positions on the destination exchange while waiting for assets to arrive, effectively locking in the current price difference regardless of market movements.

5. Track Performance and Adjust Strategy

Detailed record-keeping is essential for optimizing your arbitrage strategy over time. Track all trades including fees, transfer times, and actual profits compared to expected returns. This data helps identify which exchanges, cryptocurrency pairs, and market conditions consistently provide the best opportunities for your setup.

Pay particular attention to slippage—the difference between expected execution price and actual execution price. High slippage can turn theoretically profitable trades into losses, especially on exchanges with lower liquidity. Your tracking should also note technical issues or delays that affected profitability, helping you adjust risk management approaches accordingly.

Most successful arbitrageurs continuously refine their strategies based on performance data. This might involve adjusting capital allocation, focusing on different trading pairs, or modifying execution techniques to improve speed and reduce costs. The crypto market evolves rapidly, so strategies that worked last month may need adjustment to remain profitable.

Tools That Make Crypto Arbitrage Easier

While crypto arbitrage is theoretically simple, executing it efficiently at scale requires specialized tools. The right software can mean the difference between capturing profitable opportunities and constantly missing them by seconds. Today’s arbitrage traders have access to increasingly sophisticated tools designed specifically for identifying and executing on price discrepancies.

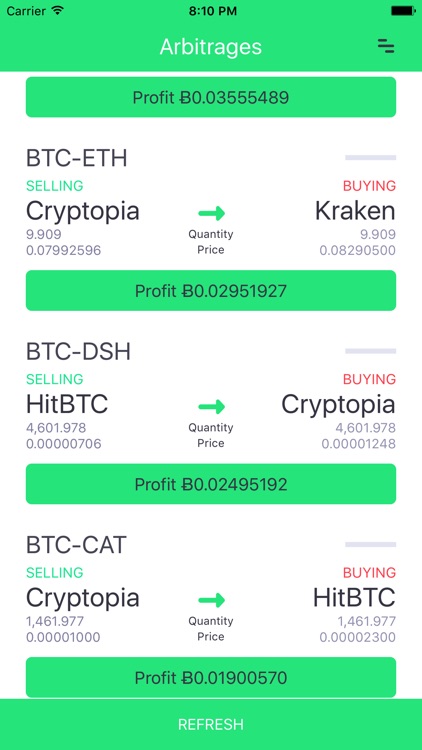

Arbitrage Scanner Apps

“Crypto Arbitrage Scanner by Donoma Games” from appadvice.com and used with no modifications.

Arbitrage scanners continuously monitor prices across dozens or even hundreds of exchanges, alerting users when potentially profitable discrepancies appear. Basic scanners simply display current price differences, while more advanced options calculate net profitability after fees and even rank opportunities by potential return. Popular options include Cryptohopper Arbitrage, ArbiSmart, and Bitsgap, though many professional traders develop custom solutions tailored to their specific strategy.

These tools typically offer customizable filters to focus on specific exchanges, trading pairs, or minimum profit thresholds. This helps traders avoid information overload and concentrate on opportunities that match their capital availability and risk preferences. Many scanners also provide historical data on price spreads, helping users identify patterns and optimize their trading windows.

Trading Bots for Automation

“Crypto Arbitrage Bots: Your Guide to …” from www.a3logics.com and used with no modifications.

Automated trading bots represent the next level of arbitrage sophistication, not just identifying opportunities but executing trades automatically when preset conditions are met. These bots connect to exchanges via APIs, allowing them to place orders within milliseconds of detecting a profitable price gap—far faster than any human could manually execute trades.

For those interested in exploring the world of automated trading, understanding the differences between crypto and forex trading can provide valuable insights.

While pre-built arbitrage bots are available through services like 3Commas, HaasOnline, and Pionex, many serious arbitrageurs develop custom solutions or modify existing open-source frameworks. Custom bots can incorporate proprietary strategies, risk management rules, and optimization techniques that provide an edge over traders using off-the-shelf solutions. The most advanced setups employ machine learning algorithms that continuously improve performance based on market conditions and trading outcomes.

For traders without programming skills, some platforms now offer “no-code” bot creation tools with visual interfaces for designing and implementing arbitrage strategies. These make automation more accessible to newcomers while still providing significant advantages over manual trading.

Profits vs. Risks: What You Need to Know

While crypto arbitrage is often portrayed as “risk-free profit,” the reality includes several significant challenges and potential pitfalls. Understanding these risks is essential for developing realistic expectations and implementing appropriate safeguards.

Potential Returns from Crypto Arbitrage

Realistic profit expectations for crypto arbitrage typically range from 0.5% to 3% per successful trade in established markets, though larger opportunities occasionally appear. These seemingly modest percentages can compound significantly when executed frequently and with substantial capital. Many active arbitrageurs report monthly returns of 5-15% during favorable market conditions, though performance varies considerably based on market volatility, capital deployment efficiency, and technological advantages.

Return potential also varies by strategy type. Cross-exchange arbitrage on major cryptocurrencies typically offers smaller but more frequent opportunities, while triangular arbitrage and DeFi opportunities might provide larger percentage returns but with higher complexity and risk. Geographic arbitrage can yield the largest single-trade profits (sometimes 10-20% during extreme conditions) but faces the most significant regulatory and operational hurdles.

Hidden Costs That Eat Into Profits

The profitability of arbitrage trades can be significantly reduced by various costs that inexperienced traders often overlook. Beyond the obvious trading fees, these include network transaction fees (which can spike dramatically during congested periods), slippage on larger orders, currency conversion fees when moving between fiat and crypto, and potential taxes on each transaction depending on your jurisdiction.

Withdrawal fees vary dramatically between exchanges and can make otherwise profitable opportunities unviable, especially for smaller trade sizes. Some exchanges also impose minimum withdrawal amounts that can lock up capital temporarily. Time delays represent another “hidden cost”—capital tied up during transfers between exchanges has an opportunity cost, as it could be deployed elsewhere during that period.

Market Risks and Volatility Concerns

While arbitrage is theoretically market-neutral, several market-related risks can impact profitability. Extreme volatility can cause prices to move significantly during the execution process, potentially eliminating the price gap before both sides of the trade are complete. During major market events, exchanges may experience technical issues, delayed withdrawals, or even temporary shutdowns that disrupt arbitrage strategies.

Liquidity risk is another consideration, particularly on smaller exchanges or with less-traded cryptocurrencies. What appears to be a profitable opportunity might not be executable at the displayed price if market depth is insufficient for your trade size. This is especially relevant for triangular arbitrage, where multiple trades must be executed with minimal slippage to maintain profitability.

Counterparty risk should not be overlooked—having funds on exchanges exposes traders to potential losses from hacks, insolvency, or regulatory actions. Most experienced arbitrageurs mitigate this by limiting exposure to any single platform and prioritizing exchanges with strong security records and insurance programs.

Common Mistakes Beginners Make with Crypto Arbitrage

New arbitrage traders often fall into several common traps that can quickly erode profits or even result in losses. Recognizing these pitfalls in advance can help you avoid costly learning experiences.

Ignoring Transaction Fees

Perhaps the most common mistake is failing to account for all fees involved in the complete arbitrage cycle. A price difference that looks profitable at first glance may actually result in a loss once trading fees, network transaction fees, and withdrawal charges are factored in. Successful arbitrageurs meticulously calculate the total cost structure before executing trades.

Each exchange has its own fee schedule, often with tiered rates based on trading volume or token holdings. Network fees vary by blockchain and congestion levels, sometimes changing dramatically within hours. Developing a comprehensive fee model that accounts for all these variables is essential for identifying truly profitable opportunities.

Forgetting About Transfer Times

- Bitcoin transfers typically take 10-60 minutes for confirmation

- Ethereum can range from 30 seconds to 15+ minutes depending on gas fees

- Solana offers near-instant transfers but with different exchange support

- Stablecoins inherit the confirmation times of their underlying blockchain

- Exchange processing adds additional variable delay

Transfer times between exchanges represent one of the biggest challenges in cross-exchange arbitrage. While a price discrepancy might exist when you initiate a transfer, market movements during the transfer period can eliminate or even reverse the opportunity by the time your funds arrive at the destination exchange.

Different cryptocurrencies have vastly different transfer times. Bitcoin might take an hour during congested periods, while assets on faster networks like Solana or Avalanche can arrive within seconds. Many professional arbitrageurs prefer to work with faster cryptocurrencies despite their potentially higher volatility, as the reduced transfer time minimizes exposure to adverse price movements.

For those interested in the technological advancements driving these changes, understanding what is edge computing can provide valuable insights.

To mitigate transfer time risks, experienced traders maintain balances on multiple exchanges rather than moving assets for each opportunity. This allows immediate execution on both sides of an arbitrage trade, eliminating transfer delays entirely. Some also use stablecoins as their primary transfer medium, accepting slightly higher fees in exchange for reduced price volatility during the transfer period.

Not Planning for Failed Transactions

Even the best-planned arbitrage trades can face unexpected technical issues. Network congestion can cause transactions to remain pending for hours, exchanges may temporarily disable withdrawals for specific assets, or API connections might fail at crucial moments. Without contingency plans for these scenarios, traders can find themselves with capital locked in incomplete transactions while prices move unfavorably. For more insights, check out this guide on crypto arbitrage.

Is Crypto Arbitrage Right For You?

While crypto arbitrage offers attractive risk-adjusted returns compared to many trading strategies, it’s not suitable for everyone. Success requires a specific combination of capital, technical capabilities, and personal traits. Before diving in, honestly assess whether your resources and skills align with the requirements of this specialized trading approach.

Capital Requirements to Start

Meaningful arbitrage trading typically requires significant capital to overcome fixed costs like trading fees and blockchain transaction fees. While you can technically begin with a few hundred dollars, most serious arbitrageurs recommend starting with at least $10,000 to generate worthwhile returns. Professional operations often deploy hundreds of thousands or even millions to maximize efficiency and profitability. For more insights, check out this article on crypto arbitrage.

Beyond the raw amount, capital flexibility is crucial. Funds must be distributed across multiple exchanges and potentially different cryptocurrencies, with sufficient reserves to capitalize on opportunities when they arise. This means having a significant portion of your portfolio dedicated to this strategy rather than just experimenting with a small percentage.

Consider also the opportunity cost—capital allocated to arbitrage isn’t available for other potentially higher-return (though higher-risk) strategies like position trading during bull markets. The steady but modest returns of arbitrage might not satisfy traders seeking more substantial growth, particularly during strong directional markets.

- $1,000-$5,000: Learning stage with minimal returns

- $10,000-$50,000: Potentially viable for part-time focus

- $50,000-$250,000: Serious arbitrage operation

- $250,000+: Professional-level arbitrage trading

- $1,000,000+: Institutional arbitrage opportunities become accessible

Most arbitrageurs start with smaller amounts while learning the ropes, then scale up as they develop efficient systems and gain confidence in their execution. This gradual approach helps minimize costly mistakes while still providing valuable real-world experience beyond paper trading.

Time Commitment Needed

Successful arbitrage requires significant time investment, particularly during the setup and optimization phases. While some aspects can be automated, developing and monitoring systems, managing capital across platforms, resolving technical issues, and staying informed about market developments demands consistent attention. Most active arbitrageurs report spending several hours daily on these activities, with many treating it as a full-time professional endeavor.

Technical Skills You Should Have

The technical barrier to entry for crypto arbitrage has decreased with the proliferation of user-friendly tools, but certain skills remain valuable. Basic programming knowledge helps with using APIs and potentially developing custom tools. Financial analysis abilities are essential for evaluating opportunities and optimizing strategies. Experience with cryptocurrency wallets, exchanges, and blockchain concepts provides important context for troubleshooting inevitable technical issues.

Perhaps most important is a methodical, detail-oriented mindset. Profitable arbitrage depends on precise execution and careful accounting for all variables that impact profitability. Those who thrive tend to enjoy process optimization and have the patience to implement and refine systems over time rather than seeking immediate dramatic results.

Frequently Asked Questions

As crypto arbitrage has gained popularity, certain questions consistently arise from newcomers interested in this trading approach. These answers provide clarification on common points of confusion and misconceptions about arbitrage strategies.

Is crypto arbitrage legal?

Crypto arbitrage itself is completely legal in most jurisdictions—it’s simply taking advantage of price differences across markets, a practice that exists in virtually every financial sector. However, regulatory compliance requirements vary significantly by country and may impact how you can execute certain arbitrage strategies, particularly those involving fiat currencies or regulated exchanges.

In some countries with strict capital controls or cryptocurrency regulations, specific forms of arbitrage might face restrictions. For example, spatial arbitrage between countries might involve currency conversion limits or reporting requirements. Some nations restrict citizens from using foreign exchanges or have specific tax reporting obligations for cryptocurrency transactions.

The legal status of certain DeFi protocols used in arbitrage strategies may also be unclear in some jurisdictions. Flash loans and other innovative DeFi mechanisms exist in regulatory gray areas in many countries. While using these tools isn’t explicitly illegal, regulatory frameworks continue to evolve, creating compliance uncertainty.

Legal Considerations by Region: While crypto arbitrage is generally legal, specific requirements vary. US traders must comply with tax reporting for each trade. EU residents face MiCA regulations affecting exchange operations. South Korean arbitrageurs must navigate strict capital controls limiting the “Kimchi premium” opportunity. Always consult with a legal expert familiar with your jurisdiction’s specific cryptocurrency regulations.

How much money do I need to start with crypto arbitrage?

While you can technically begin exploring arbitrage with as little as $500-1,000, most experienced traders recommend starting with at least $10,000 to generate meaningful returns after accounting for fees and other costs. The strategy becomes increasingly efficient with larger capital bases, as fixed costs represent a smaller percentage of each trade. Professional arbitrageurs typically operate with $50,000+ to maximize profitability and access a wider range of opportunities.

Can I do crypto arbitrage with just one exchange?

Yes, through triangular arbitrage. This strategy exploits price inefficiencies between different trading pairs on the same exchange. For example, you might convert BTC to ETH, then ETH to USDT, and finally USDT back to BTC, potentially ending with more BTC than you started with if the trading pairs aren’t perfectly aligned. While this eliminates transfer delays between exchanges, triangular opportunities are typically smaller and more fleeting than cross-exchange opportunities, requiring sophisticated monitoring tools to identify and execute profitably.

Do I need coding skills for crypto arbitrage?

Basic coding skills are helpful but not strictly necessary for getting started with crypto arbitrage. Many third-party tools and platforms now offer user-friendly interfaces for identifying and even executing arbitrage opportunities without requiring programming knowledge. However, as you advance, the ability to use APIs and create custom scripts can significantly improve your efficiency, allowing for faster execution and more sophisticated strategies that may provide an edge over traders using only off-the-shelf solutions.

Are crypto arbitrage profits taxable?

Yes, profits from crypto arbitrage are generally taxable in most jurisdictions, though specific treatment varies by country. In the United States, each cryptocurrency transaction potentially creates a taxable event, requiring detailed record-keeping of acquisition prices, sale prices, and holding periods. Some countries may classify frequent arbitrage trading as business income rather than capital gains, potentially affecting tax rates and available deductions.

The tax complexity of arbitrage is significantly higher than simple buy-and-hold strategies due to the high transaction volume. Most serious arbitrageurs use specialized crypto tax software to track their trading activity across multiple platforms and generate compliant tax reports. Some also work with tax professionals who specialize in cryptocurrency to optimize their tax strategy while maintaining compliance.

For traders using DeFi protocols and more complex strategies like flash loans, tax treatment may be particularly unclear as regulations continue to evolve. Conservative accounting approaches are advisable given the regulatory uncertainty in this rapidly developing space.

Join the Conversation