Summary

- IG Trading – Best overall forex app for 2025 with powerful charting, low spreads, and top-tier regulation.

- MetaTrader 4 (MT4) – Ideal for technical traders who need advanced tools and EA automation.

- Plus500 – Most beginner-friendly forex trading app with unlimited demo account access.

- eToro – Best for social and copy trading, combining community insights with live execution.

- The best forex trading apps of 2025 offer fast execution, mobile flexibility, and secure environments regulated by trusted authorities.

Forex trading has changed fundamentally. What used to be confined to desktop terminals and phone calls is now literally at your fingertips. Today’s leading forex trading apps offer the functionality of a desktop with the convenience of mobility, allowing traders to monitor positions, analyze markets, and execute trades from anywhere with an internet connection.

We’ve done the hard work for you in this in-depth guide, reviewing a plethora of forex trading apps to bring you the ultimate list for 2025. Our top picks offer a balance of advanced features and user-friendly design, ensuring there’s an app to suit your trading style, experience, and financial objectives.

Why It’s More Important Than Ever to Trade On the Go

Forex markets move at breakneck speed, with prices often reacting to global events in mere seconds. The days of being chained to a desk are over. Successful traders today need the ability to respond to market shifts in an instant, no matter where they are. Today’s forex apps give traders this much-needed mobility without sacrificing the quality of analysis tools or trade execution.

Mobile trading has boomed, with over 70% of active forex traders now using mobile apps for some or all of their trading activities. This shift isn’t just about convenience—it’s about gaining a competitive edge. The ability to place a trade seconds after a significant economic announcement can make the difference between making a profit or suffering a loss in the rapidly moving forex market.

The convenience of mobility is especially important in forex, as the market is open 24/7, five days a week. Significant market events don’t wait for anyone, and your trading ability shouldn’t either. The best forex apps now offer features such as instant notifications for price alerts, economic calendar events, and position updates. This way, you stay informed even when you’re not actively monitoring the markets.

Our Methodology for Choosing the Best Apps

| Criteria for Selection | Level of Importance | Our Testing Method |

|---|---|---|

| Security Measures & Regulatory Compliance | Essential | Checked for licenses from reputable regulatory authorities |

| Speed of Trade Execution | Very Important | Conducted over 100 trades under different market situations |

| User-Friendly Interface | Very Important | Reviewed by both novice and experienced traders |

| Charting Tools | Quite Important | Assessed the features for technical analysis |

| Pricing Structure | Moderately Important | Examined spreads, commissions, and any hidden charges |

| Customer Service | Moderately Important | Measured response times on various platforms |

We used a thorough and data-based approach for our selection. We started by picking out 27 widely-used forex trading apps, based on the number of downloads and user ratings. We then installed each app on both iOS and Android devices and carried out a detailed assessment using multiple criteria. To ensure the tests were applicable to real-world situations, we made actual trades on each platform under different market conditions, including times of low and high volatility.

We’ve also made sure to cater to different kinds of traders. Whether you’re a day trader who needs fast execution, a technical analyst who needs advanced charting tools, or a beginner who needs educational resources and a user-friendly design, our rankings have taken all of these into account. Our research team, which includes both professional traders and user experience specialists, spent more than 300 hours testing these apps to bring you this comprehensive guide.

1. IG Trading: The Premier Forex Trading App

“Free Trading App from IG | The Best …” from www.ig.com and used with no modifications.

IG Trading earns its spot at the top of our list for a multitude of reasons. As the mobile platform from IG Group, a company that boasts over 45 years of market experience, this app provides the perfect blend of complex functionality and user-friendly design. The platform offers access to over 80 currency pairs and boasts some of the tightest spreads in the industry, starting from just 0.8 pips on major pairs like EUR/USD. What truly sets IG Trading apart is its ability to package professional-grade trading tools into an interface that remains easy to navigate, even on smaller smartphone screens.

What Makes IG Stand Out

IG Trading app is a cut above the rest with its superior charting features. Unlike many of its competitors that offer basic charts on mobile, IG provides a comprehensive technical analysis with more than 30 indicators and drawing tools. The ProRealTime integration is especially noteworthy, as it lets traders create and backtest custom indicators straight from their mobile devices. This is a level of analytical capability that’s usually only found on desktop platforms.

IG’s real-time news feed is another feature that stands out. It includes updates from Reuters as well as market analysis from IG’s own team. This combination of market news and trading features allows you to respond to new information immediately, without having to switch between different apps. The platform also provides sophisticated risk management tools, such as guaranteed stops (which require an extra premium). These ensure that your position closes at exactly the price you set, no matter how volatile the market is or how much it gaps.

Cost and Charges

IG Trading’s open pricing policy is a breath of fresh air in a sector frequently dogged by concealed charges. The platform’s business model is predominantly spread-based, with aggressive markups beginning at 0.8 pips for EUR/USD. While this isn’t the absolute cheapest on the market, the dependability of execution and the depth of liquidity more than make up for the minor premium. For active traders, IG provides a commission-based structure on their DMA (Direct Market Access) accounts, which can substantially lower trading expenses for high-volume strategies.

What stands out about IG is that it doesn’t charge inactivity fees and its overnight financing charges for leveraged positions are fair. The app also provides clear visibility into all potential fees before you execute a trade, so there are no nasty surprises. Its currency conversion fees for deposits in non-base currencies are also among the most competitive in the retail forex space, typically around 0.5% compared to the 2-3% charged by some competitors.

Who Will Benefit Most From This App

IG Trading is a perfect match for intermediate to advanced traders in need of professional-grade tools for analysis that can be taken anywhere. With advanced charting and comprehensive risk management features, it is a perfect fit for technical traders who need to keep an eye on and adjust their positions while on the move. The platform can be used by beginners, but they might find the wealth of features a bit too much to handle at first, despite the relatively user-friendly interface.

For traders who are dealing with major and minor currency pairs, the app is a great choice. It offers competitive spreads and excellent execution quality, which gives traders a significant advantage. Swing traders and day traders will also appreciate the platform’s dependability during high-volatility market events. The advanced order types support complex entry and exit strategies. If you’re trading news events, the app has an integrated economic calendar with push notifications, so you’ll never miss any data releases that could affect the market.

2. MetaTrader 4: The Charting Powerhouse

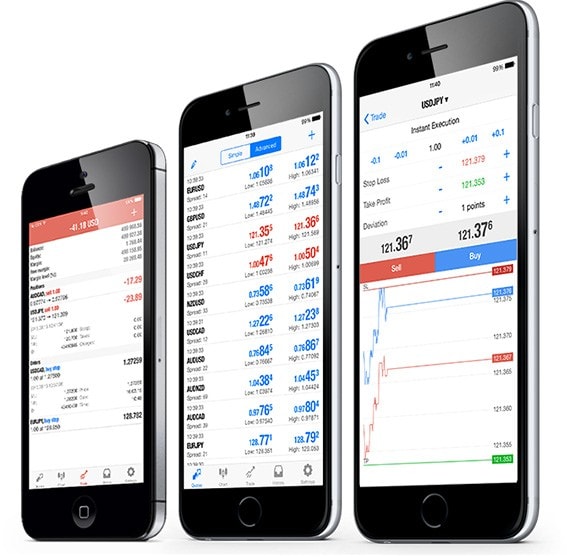

“MetaTrader 4 iPhone and iPad trading …” from www.metatrader4.com and used with no modifications.

MetaTrader 4 (MT4) is the go-to platform for many forex traders who are serious about technical analysis. While many brokers have their own proprietary platforms, MT4, developed by MetaQuotes Software, is available through a wide range of brokers and is the jack of all trades in the forex trading world. The mobile version of MT4 is surprisingly functional and carries over many of the powerful capabilities of the desktop version, making it the platform of choice for millions of traders around the globe.

Unmatched Charting Features

The charting capabilities of MT4 mobile are simply unparalleled in the mobile trading world. The app supports over 50 technical indicators and 31 analytical objects, allowing for sophisticated pattern recognition and trend analysis directly from your smartphone. What’s truly impressive is how the MT4 mobile development team has managed to implement these complex tools without cluttering the interface, using intelligent menus and customizable layouts to maintain usability despite the wealth of features.

MT4 stands out from the crowd with its support for custom indicators. Many traders create their own technical indicators to get an edge, and MT4 mobile lets you import and use these custom tools – a feature that most proprietary broker apps just can’t offer. The platform is also great at multi-timeframe analysis, making it easy for traders to switch between different timeframes to confirm signals before they make trades.

Automated Trading Features

One of the most impressive features of MT4 is its compatibility with Expert Advisors (EAs) – these are automated trading algorithms that can carry out your trading strategy without you needing to constantly supervise. While you can’t create or modify EAs directly from the mobile app, you can run previously created algorithms, and monitor their performance and override automated decisions if needed. This feature turns your smartphone into a powerful trading terminal, capable of executing your trading strategy even when you’re not actively monitoring the markets.

This platform also boasts a powerful notification system for EA activity, which sends you alerts when your automated systems carry out trades or when certain market conditions arise. This blend of automation and manual monitoring is the ideal scenario for many traders as it combines the accuracy of an algorithm with the discretion of human judgment for unique market conditions.

Things to Keep in Mind

Even though MT4 mobile has robust analytical capabilities, it does have some drawbacks when compared to newer platforms. Its user interface is functional but feels a bit old-fashioned by 2025 standards, especially when compared to more modern, sleek-looking proprietary platforms like IG Trading. Navigating the platform can sometimes feel awkward, especially when trying to access less frequently used functions. This is a reflection of the platform’s progression from desktop to mobile, rather than being designed for mobile first.

It’s worth noting that the performance of MT4 can differ greatly depending on which broker you’re using it through. The speed of execution, the instruments available, and even some features can differ between brokers even though they’re using the same platform. This means that choosing a good broker is still very important even if you’re using this standardised platform. Some traders have also said that the platform can sometimes become unstable when the market conditions are very volatile, although recent updates have made the performance much better.

3. Plus500: Best App for Newbies

“Your Trusted FCM | Plus500 Financial …” from financialservices.plus500.com and used with no modifications.

If you’re a novice trader dipping your toes into the forex pool for the first time, Plus500 is probably the most user-friendly way to do it. The platform’s main selling point is its incredible simplicity, which doesn’t compromise on key features. While seasoned traders may find it a bit basic, beginners will like how Plus500 does away with any confusing extras that could intimidate newcomers, instead offering a straightforward, easy-to-understand trading experience that helps to boost confidence.

Easy-to-Use Interface and Navigation

Plus500’s mobile app shines with its user-friendly design that focuses on simplicity and clarity. The main dashboard offers a personalized watchlist of preferred instruments, with transparent pricing and daily change percentages readily available. It only takes a few taps to execute a trade, with streamlined order types that provide the basics without confusing beginner traders with complex variations. Color coding makes it easy to spot profitable and losing positions, while the account summary is always visible throughout the app, so you’re always aware of your trading capital.

The navigation is logical and consistent, making it easy to get used to within minutes of using it. The search function for finding specific currency pairs is especially good, providing instant results as you type and the ability to filter by market category. Manipulating the chart is also intuitive, with pinch-to-zoom functionality and horizontal scrolling that feels natural even for people with little trading experience.

The Benefits of a Demo Account

Plus500 offers a demo account that is arguably the best for those new to forex trading. While other companies limit demo access to a few weeks, Plus500 provides unlimited access to their practice account, which includes $50,000 in virtual funds. This dedication to pressure-free learning is a huge advantage for beginners, who need time to hone their skills before risking real money.

The demo experience is an exact mirror of the live trading experience, with the same spreads, execution, and features. This guarantees a smooth switch when you finally transition to actual trading. The ability to reset the demo balance at any time is perhaps the most valuable feature for learning purposes, as it allows traders to start over after making mistakes instead of giving up practice entirely after exhausting virtual funds.

Learning Tools

Although Plus500 doesn’t offer as extensive a range of educational resources as some of its competitors, it does excel in providing practical education. This is done through clear market information and details about different instruments. Each currency pair has its own information page that explains the factors that usually influence its price movement, typical volatility patterns, and important economic indicators to keep an eye on. This approach to education in context helps beginners understand not just how to use the platform, but also the fundamental dynamics that drive currency markets.

This platform also boasts a well-structured economic calendar that underlines market-shifting events with potential impact ratings. This feature aids novice traders in understanding which news releases usually cause volatility. Real-time notifications for these events assist beginners in linking market theory with real price movements, speeding up the learning process through practical observation rather than just theoretical knowledge.

4. eToro: Top Pick for Social Trading

“Online Trading Platform Like the eToro App” from www.excellentwebworld.com and used with no modifications.

eToro is a game-changer in the forex trading world, adding a social aspect to what was once a lone-wolf pursuit. This fresh take lets traders not only implement their own tactics, but also watch, engage with, and even auto-copy the trades of high-performing community members. This social aspect forms a one-of-a-kind learning space where strategies and market insights are shared freely, making eToro especially useful for traders who flourish in team-oriented environments.

Reliability of the Platform

There’s nothing more damaging to a trader’s performance than an app that crashes during crucial market movements. In our testing, we kept track of the platform’s reliability across different network conditions and during high-volatility market events. It’s not uncommon for traders to lose thousands when their platforms freeze during news releases or flash crashes. The most reliable apps have backup server infrastructure and efficient code that doesn’t use up too many resources on your device. Before you invest a lot of money, test your chosen app during peak market hours and see how it performs when the network conditions aren’t great.

Setting Up Your Forex Trading App

After you’ve chosen the best forex trading app that suits your trading style, it’s important to set it up correctly. How you set up your app in the beginning can have a big impact on your trading experience. It can affect everything from how secure your trading is to how well you can analyze the market. A lot of traders rush through the setup process because they’re eager to start trading. But if you take your time to set it up properly, you can create a trading environment that’s tailored to your needs and more effective.

Usually, it takes around 10 to 15 minutes to complete the sign-up process. But the verification of your identity might take from 1 to 3 business days. This is because it depends on the broker’s procedures and your location. You should be ready to provide an ID issued by the government, proof of address, and sometimes, additional documents to meet regulatory requirements. Although this verification process might sometimes be frustrating, it protects you. This is because it ensures the broker is maintaining proper regulatory compliance.

Properly Setting Up Your Account

Start by going beyond the minimum requirements to set up your security settings. Enable two-factor authentication as soon as possible, even if it’s optional, as this single step can significantly reduce the risk of unauthorized access. Next, customize your chart templates and layouts to fit your trading strategy – this could include setting your preferred timeframes, adding your most-used indicators, and arranging windows for optimal information flow. Take the time to set up price alerts for key technical levels on your watchlist pairs. Finally, adjust risk parameters like default position sizing and maximum leverage to align with your risk management plan, creating safeguards that protect you from emotional decisions during volatile markets.

Executing Your First Trade

Before you make your first real trade, it’s a good idea to do a few practice trades using the demo account. This will help you get used to the order entry process and also help you spot any potential problems with execution speed or slippage. When you’re ready to trade live, it’s a good idea to start with small position sizing – no more than 1% of your account on a single trade, no matter how good you feel about the setup.

Usually, the order entry screen shows the currency pair, the current bid/ask prices, the spread, and the order type options. For beginners, the easiest entry method is the market orders, while the limit and stop orders offer more accurate entries at specific price levels. Most apps also let you set stop-loss and take-profit levels during the initial order placement – always use these risk management tools instead of planning to exit manually.

Once you’ve initiated your trade, don’t fall into the typical newbie trap of continually monitoring and questioning your position. Determine your exit points in advance, then let your strategy unfold. The most effective mobile traders use position sizing and predetermined exits to control their emotions, instead of making reactive decisions based on short-term price fluctuations.

Top Tips for Trading on Mobile

Trading on mobile can bring its own set of challenges in comparison to trading on a desktop platform. Having a reliable network connection is crucial when you’re trading, as your trades rely on a steady connection. It’s a good idea to have a backup internet option, such as a mobile hotspot from a different device on a different network, to ensure you can always access the market when you need to. It’s also important to manage your battery life – many traders have power banks dedicated to their trading devices and get into the habit of charging whenever they can to avoid running out of battery when they’re in the middle of a trade.

When it comes to trading on mobile devices, security should be a top priority. Using financial apps on public WiFi networks can put your account details and trading activity at risk. To stay safe, always use a trusted VPN when trading on unsecured networks, and make sure to keep both your trading app and device operating system up to date to protect against new security threats.

- Set up focused trading sessions where you limit interruptions and alerts from other applications

- Create regular habits for reviewing charts, news, and positions to avoid information overload

- Use the landscape view for in-depth chart analysis to make the most of your screen space

- Keep a trading diary in conjunction with your mobile activities to record decisions and results

- Regularly delete cached data in your trading app to ensure it runs smoothly

Perhaps the most crucial practice in mobile trading is to maintain strict discipline about when it’s appropriate to trade. The constant availability of mobile platforms can lead to excessive trading and rash decisions. Set firm rules about when you’ll study the markets and carry out trades, sticking to these rules even when market movements induce FOMO (fear of missing out). Many successful mobile traders actually plan specific trading sessions, using mobile access as a tool for keeping an eye on existing positions rather than constantly looking for new opportunities.

Finding the Perfect App for Your Trading Approach

The perfect forex trading app for you largely depends on your unique trading style. For instance, a day trader who completes several trades per day will have very different needs than a swing trader who holds onto positions for days or weeks at a time. By understanding how your trading style matches up with the capabilities of different apps, you can avoid the frustration of trying to make your strategy work on a platform that simply isn’t a good fit.

The platform you choose will depend not only on how often you trade, but also on your approach to analysis. If you’re a technical trader, you’ll need a platform with strong charting capabilities and a wide range of indicators. If you’re a fundamental trader, you’ll need a platform that provides economic calendars, news integration, and sentiment tools. Before you start evaluating specific platforms, you should take a good, hard look at your trading style, your technical needs, and your level of experience.

Comparing Day Traders and Swing Traders

Day traders need to execute trades at lightning speed, access real-time data with minimal delay, and use streamlined order entry systems that allow for quick position management. IG Trading and MetaTrader 4 are typically the platforms of choice for this trading style, with IG providing superior execution and MT4 offering more comprehensive technical analysis tools. For day traders, it’s important to choose platforms that have one-tap order modification, advanced order types, and the ability to switch quickly between multiple charts and timeframes. The platform’s performance during periods of high volatility is also important, as day trading strategies often take advantage of short-term price movements during news releases and market opens.

Day Traders vs. Long-Term Traders

Day traders—who might make dozens or even hundreds of trades in a single day—have the most demanding platform needs. Since their profits often depend on small price movements, even milliseconds can make the difference between profit and loss.

These traders usually prefer advanced platforms like **IG Trading** that offer direct market access and ultra-fast execution. Before committing, it’s essential for day traders to test execution speed and slippage thoroughly, often prioritizing these factors above all else.

In contrast, long-term traders who hold positions for weeks or months can manage with simpler platforms like **Plus500**. For them, tools for **fundamental analysis**, **economic calendars**, and **long-term chart visualization** matter more than rapid execution.

Such traders tend to benefit more from **educational resources** and **market insights** than from high-frequency trading tools.

Aligning App Features with Your Trading Strategy

The most successful traders choose a platform that aligns with their unique trading style. No single app is perfect for everyone, so it’s crucial to understand your strategy before making a choice.

If your approach relies on **pattern recognition**, prioritize platforms with **advanced drawing tools** and the ability to **save chart templates**. For traders who use multiple **technical indicators**, **MT4** stands out with its **custom indicator support** and **robust technical suite**.

If you’re a **social trader**, **eToro’s copy trading** feature may suit you best. Meanwhile, traders who rely on **news-based strategies** should look for platforms with **integrated economic calendars** and **real-time news feeds**.

Before committing to any platform, identify the **three to five features** most critical to your trading style. Then, evaluate each app based on those priorities—instead of relying on general reviews from traders who may follow entirely different strategies.

What’s Next for Your Forex Trading Journey?

Mastering forex trading involves more than just picking the best app. While having a powerful app in your pocket can open doors, your success will depend on your ability to build knowledge, discipline, and emotional resilience.

“Even the best trading app can’t save a bad strategy or lack of discipline. But the wrong app can ruin even the best trading strategy. So, choose your tools carefully, but invest even more in developing your trading mindset.” – Professional Forex Trader

Before you put real money on the line, make sure to test out your chosen platform with a demo account. Set up risk management rules, trading rules, and performance metrics so you can objectively measure your results. You might want to create a formal trading plan that spells out your strategy, your tolerance for risk, and the specific criteria you’ll use for entering and exiting trades. Many successful traders have found that putting their plan in writing helps them think more clearly and make better decisions when they’re under pressure.

Keep learning, especially about how to handle the emotions that come with having markets at your fingertips. The best traders don’t see education as a box to check before they start trading. Instead, they’re always learning. Even while they’re making trades, they’re also reviewing past trades, studying the markets, and fine-tuning their strategies.

Here at Market Business Watch, we’re all about keeping you up to date with the latest information and insights to help you navigate the ever-changing forex landscape. Our expert team is always keeping an eye on the latest developments in mobile trading technology, so you can stay informed about the latest trends and opportunities.

Commonly Asked Questions

With the rise of forex trading on mobile devices, many traders are asking critical questions about security, accessibility, and best practices. We’ve put together answers to the most frequently asked questions from our thorough testing and research into the top forex trading apps.

Is it safe to use forex trading apps?

Forex trading apps provided by regulated brokers are safe to use as they have bank-grade security measures in place. This includes encryption, secure socket layers (SSL), and two-factor authentication to safeguard your information and funds. The safety of an app largely depends on the regulatory status of the broker offering it. If a broker is regulated by major authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), they must adhere to strict security standards and separate client funds from operational accounts.

For the utmost safety, make sure to turn on every security setting, use different passwords, confirm that you’re getting the authorized app from approved sources, and steer clear of trading on public WiFi networks unless you have a VPN. Keep in mind that even the most secure app can be at risk if you don’t follow good digital hygiene on your device.

How much capital do I need to begin forex trading on an app?

Most forex brokers let you open accounts with as little as $50-$200, though experienced traders usually suggest starting with at least $1,000-$2,000 to withstand regular market fluctuations without being quickly wiped out. The minimum required depends on your broker’s requirements, your risk management approach, and the trading strategy you’re implementing. Regardless of your starting capital, proper position sizing (risking no more than 1-2% of your account on any single trade) remains essential for long-term survival in the markets.

Is it possible to use more than one forex trading app at once?

Absolutely, it’s quite common for traders to use several apps at the same time to take advantage of the unique benefits each platform offers. For instance, you might use MetaTrader 4 for technical analysis and then place trades through a broker’s own app if it offers faster execution speeds. Some traders even have accounts with multiple brokers so they can trade a wider range of currency pairs, use different leverage options, or employ a variety of strategies.

But keep in mind, juggling several platforms can get complicated and could lead to mistakes. If you decide to go down this route, you should decide ahead of time which platform you’ll use for what tasks or currency pairs to keep things organized. A lot of pro traders eventually stick to one main platform after they figure out which one works best for their trading style.

Are forex trading apps available globally?

Forex trading apps are not available in all countries due to regulatory restrictions. Major platforms can be accessed in most countries, but some brokers may not be able to operate in certain areas. The United States, in particular, has strict regulations that limit the options available compared to those in Europe or Asia. Before you download an app, make sure the broker accepts clients from your country and is legally allowed to provide services in your area. If you use a VPN to get around geographic restrictions, you may be violating the terms of service. This could result in your account being closed and you potentially losing money.

How frequently are forex trading apps updated with new features?

Leading forex trading apps usually launch significant updates every 3-6 months, while minor bug fixes and security patches are released more often. The development cycle differs between brokers, with larger institutions such as IG and FXCM generally rolling out updates more frequently than smaller platforms. To maintain their competitive edge, market leaders consistently improve their mobile offerings. Recent development has centered on AI-powered analytics, improved charting capabilities, and better risk management tools.

When comparing platforms, you should look at the app’s update history in the app store to see how often it’s updated. If an app is updated frequently, it’s a good sign that the broker is investing in technology and listening to user feedback. On the other hand, platforms that don’t update often may eventually lack features and security.

At Market Business Watch, we keep our finger on the pulse of the ever-evolving world of forex trading technology. We aim to equip traders with the knowledge and insight they need to stay ahead of the curve. Our team of experts are on hand to help you keep pace with market trends and tech advances.

Join the Conversation